The rapid growth of electric vehicles in recent years has created a unique strategic opportunity for electric utilities. This expanding market offers utilities the potential for greater revenue, improved consumer satisfaction, achievement of ESG objectives, and many other benefits. In response, however, each utility must determine what role to play in advancing and supporting EV adoption and how best to take advantage of these opportunities.

Defining that optimal role should be accomplished through a rigorous strategic planning process with delineated steps and planning outputs. Utility leaders should avoid simply staking out a position in electric vehicles space without a clear purpose.

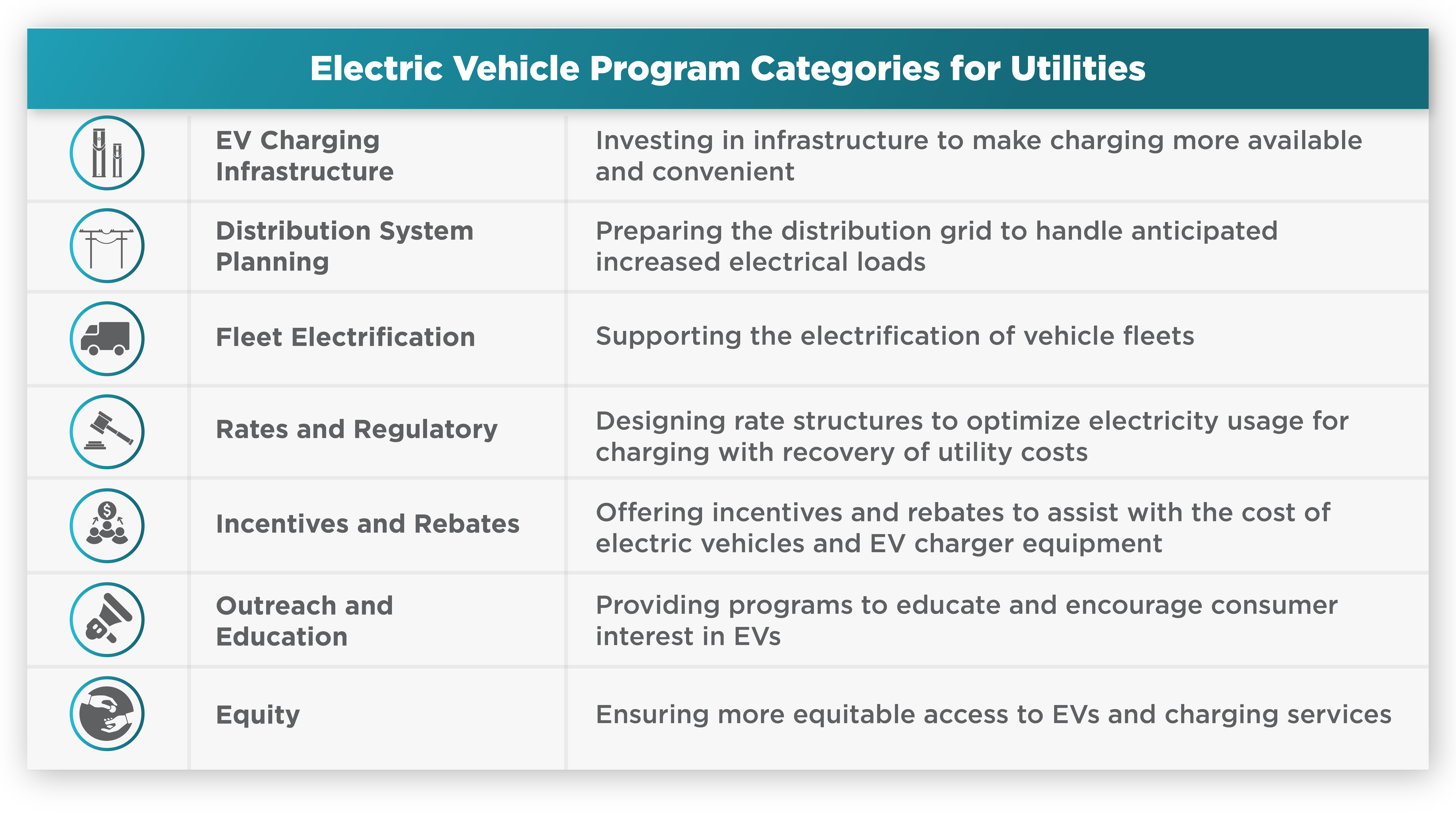

Once the specific objectives and success measures have been identified, implementation of the strategic plan generally involves establishing programs in one or more of the following categories.

Leading EV Practices

Today, most electric utilities offer programs within at least one of these categories.

ScottMadden has conducted a review of electric utility program offerings to identify and highlight some of these industry leaders.

Market Leaders: EV Charging Infrastructure

Limited access to DC fast charging is a key barrier to greater EV adoption. Electric utilities can consider becoming more directly involved in making this infrastructure widely available. The Tennessee Valley Authority (TVA) is leading the development of Fast Charge TN Network, a DC fast-charging network across the multi-state service territory with more than 60 charging station sites. Work is well underway with target completion by 2026. Rocky Mountain Power and Arizona Public Service have each partnered with Electrify America to offer DC fast charging stations in their service territories on a private label basis.

For residential charging, most EV owners prefer the speed of a Level 2 unit, which can be expensive. To help with the up-front cost, Florida Power & Light has partnered with Enel X Way to offer the FPL EVolution Home program. FPL customers can receive a Level 2 smart charger for a fixed monthly fee. Also bundled into the monthly fee is unlimited renewable electricity for off-peak charging and the cost of the charger including installation and permitting.

Market Leaders: Distribution System Planning

Electric utilities are using data analytics and other tools to forecast how increased EV adoption and the use of electricity for charging will impact the utility’s distribution system. Managed charging programs can be an effective means of encouraging EV drivers to charge only during off-peak times, thereby lessening the grid impact.

Con Edison, Orange & Rockland and other New York electric utilities are offering Smart Charge NY, a managed charging program that pays cash incentives to EV drivers for limiting charging to defined off-peak periods. Charging data is automatically collected from the vehicle’s onboard telematics or through a home-smart charging station. Smart Charge NY has recently been expanded to include commercial customers.

EverSource utilities in Connecticut, Massachusetts, and New Hampshire are offering EV drivers $10 per month in credit as long as 80% of charging time occurs during off-peak hours. Participants can earn additional cash incentives by avoiding charging during defined peak alert periods.

Market Leaders: Fleet Electrification

Vehicle fleets represent a significant opportunity for electric utilities to support large commercial, industrial, and government customers in electrification. Fleet owners are increasingly looking to the local electric utility for these services. For utilities, fleet advisory services offer the benefit of identifying potential fleet electrification loads early in the development process.

Some larger electric utilities are already offering fleet electrification consultation services. These range from online readiness assessments to engineering resources that can design charging infrastructure, assess rate options, and customize an overall fleet electrification plan.

Georgia Power, Duke Energy, and Ameren each offer these types of fleet electrification services. In 2023, Duke Energy announced plans to construct a “first-of-its-kind performance center” to accelerate the development, testing and deployment of medium- and heavy-duty commercial electric vehicle fleets. Partners include Electrada, an electric fuel solutions company, and Daimler Truck North America.

Market Leaders: Rates & Regulatory

Many electric utilities now offer EV-specific rate structures for residential customers. These rates almost always include a dual time-of-use structure (i.e., on-peak, off-peak) often with seasonal differentiation as an important means of encouraging off-peak charging. EV-specific rates also often require the use of a separate meter for charging, providing the utility with valuable insights into charging behaviors and preferences.

For owners of DC fast charging stations, demand charges present a key hurdle to investment in new infrastructure. A group of electric utilities including TVA, SDG&E, PG&E, EverSource, and the Joint Utilities of New York have introduced wholesale EV rate structures that provide alternatives to traditional demand charges. These alternatives include rate structures with either no demand charge component, demand charge holiday periods, rebates for demand charges, or a fixed component for the demand charge portion.

Market Leaders: Incentives & Rebates

Incentives and rebates are among the most well-established utility EV program offerings and can serve as an important means of lowering the upfront costs of both the electric vehicle and charging equipment.

Electric utilities now frequently offer rebates to help with the cost of a Level 2 charger including installation. These rebates are often substantial. A review of more than 70 utility rebates for residential Level 2 chargers found an average rebate amount of $841 per charger. [1]

Austin Energy offers EV owners a rebate of 50% of the purchase and installation cost of a Level 2 charging station up to a maximum $1,200. Duke Energy offers a one-time credit of up to $1,133 per charger to help residential customers cover the installation cost of a Level 2 charger.

[1] Alternative Fuels Data Center (https://afdc.energy.gov/laws) – U.S. DOE

Market Leaders: Outreach & Education

Dedicated programs designed to provide customer outreach and education can be a useful means of improving awareness and understanding of EVs and encouraging adoption. Many utilities now offer some form of electric vehicle education and awareness. More unique approaches include direct engagement with regional auto dealers and online videos and social media campaigns.

Arizona’s Salt River Project and other utilities have partnered with WattPlan to offer an online pricing calculator which allows customers to compare the financial and operating impacts of switching to an electric vehicle. The calculator incorporates customer profile information such as annual income and geographic location with the utility’s available EV rates and related incentives.

TVA provides customers with awareness and education about electric vehicles through an online “Life with an Electric Vehicle” video series. The videos are five to eight minutes in length and involve local celebrities driving an electric vehicle for a day.

Market Leaders: Equity Programs

Equity is critical for utilities to consider as electric vehicle adoption grows. Underserved communities are often those that could benefit most from a transition to cleaner transportation. Utilities may evaluate any of several EV program options including EV car sharing, public transit, and low-income incentives. Car sharing makes vehicle access a community resource, helping drivers save money, reducing air pollution, and lowering traffic congestion and parking demand.

Xcel Energy Minnesota has partnered with the City of Minneapolis and HOURCAR to provide Evie Carshare, which provides participants with access to an electric vehicle without having to own one. Plans are available for a small monthly fee. Electric vehicles may be picked up and returned to designated locations any time of the day or night within the 35 square-mile program service area. Ameren Missouri and Rocky Mountain Power have partnered with Forth Mobility and Live Electric, respectively, to offer similar EV ride-share programs.

The growth in electric vehicle adoption is creating new strategic opportunities and considerations for utilities. This expanding market offers the potential for greater revenue and improved consumer satisfaction among other benefits. Utility leaders should be deliberate in defining an optimal role within this EV market.

Understanding the baseline and leading practices that currently exist for electric vehicles programs is an important step for a utility in identifying this role and designing EV program offerings.

How ScottMadden Can Help

ScottMadden works with our utility clients to develop electric vehicle strategies and design and implement EV programs. We have assisted clients with several of the leading practice EV programs described in this article.

ScottMadden knows energy from the ground up. Since 1983, we have served as consultants for hundreds of utilities, large and small, including all of the top 20. We focus on Transmission & Distribution, Grid Edge, Generation, Gas, Rates & Regulation, and Corporate Services.

Our broad, deep utility expertise is not theoretical—it is experience-based. We have helped our clients develop strategies, improve critical operations, reorganize departments and entire companies, and implement myriad initiatives.

*Other contributors include: Holly Thompson, Dylan Royalty, and Aneketh Gurumurthi