In November 2024, Brad DeMent and Trey Robinson from management consulting firm ScottMadden delivered a webinar to discuss the results of their latest finance shared services benchmarking study. Designed by ScottMadden and administered by APQC in June 2024, the study gathered data from respondents in 103 shared service organizations (SSOs) across four main areas:

- Delivery model and operations

- Staffing

- SSO management infrastructure and technology

- Performance

Drawing from the results of the survey, this article highlights key findings and analysis related to automation and AI in Finance Shared Services.

Automation and AI: The Possibilities and the Reality

According to research carried out by CFO Dive and Tipalti, more than three-quarters of CFOs (76%) say that manual tasks absorb too much time. Technologies driven by robotic process automation (RPA), virtual agents, and artificial intelligence (AI) have the potential to reshape this landscape by taking over highly manual work. For example, Robinson shared research showing that 40% to 60% of finance processes can be automated.

Automating transactional finance work can enhance efficiency while aligning with strategic priorities like cost savings. For example, ScottMadden found that SSOs that leverage automation require fewer full time-equivalent employees (FTEs) and have a lower median cost to operate their SSO relative to the comparison group (Figure 1). DeMent explained that “AI now offers organizations the capability of moving past Tier 1 transactional automation and to push more Tier 2 problem solving and Tier 3 analytical work to self-service, fundamentally changing our delivery models, processes, and required skill sets in shared services and global business services (GBS). We expect AI to significantly increase this gap over the next 2-3 years.”

Degree of Implementation

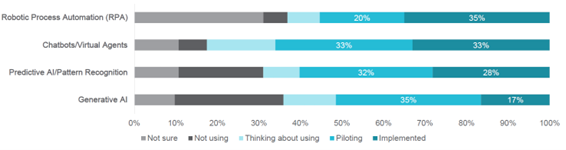

ScottMadden found that 76% of surveyed SSOs are either piloting or implementing at least one automation technology (Figure 2). RPA is the technology with the most widespread implementation (35% of respondents), while generative AI is the most piloted technology (35% of respondents).

At first glance, it may seem that many SSOs are lagging when it comes to RPA, with 30% saying they are “not sure” about the adoption rate for this technology. DeMent said this result may in fact be a sign that many SSOs are growing more mature: “RPA has been around for 15-plus years now. We find many organizations embrace citizen development models where shared service employees build bots to automate everyday work, much like they would a spreadsheet to help with a particular problem. So, a complete understanding of the extent of RPA implementation in a shared service or GBS is becoming less evident.”

Leaders Are Proceeding with Caution When It Comes to AI

While many leaders view AI as a high priority for their SSOs, they are still proceeding with caution for now. “Executives know they need to do something and are often directing SSO and GBS leaders to look for AI traction. We have found it’s hard to articulate what you want AI to do unless you see it in rapid prototypes. There’s also concern about bias, hallucinations, and the exposure of intellectual property, which can be alleviated by first using AI to generate synthetic (or artificial) data to show wins or fail fast with prototypes. Once organizations have a successful prototype, other governance questions must be addressed such as quality assurance, security, and whether to build or buy,” DeMent said. As a result, “very few SSOs have developed a simple three-year roadmap that clearly describes where they want to go with AI.” While more basic AI applications like chatbots and intelligent automation have already seen wider adoption, generative AI and other technologies may take longer to gain traction.

Top Performers Are More Mature in Automation Technologies

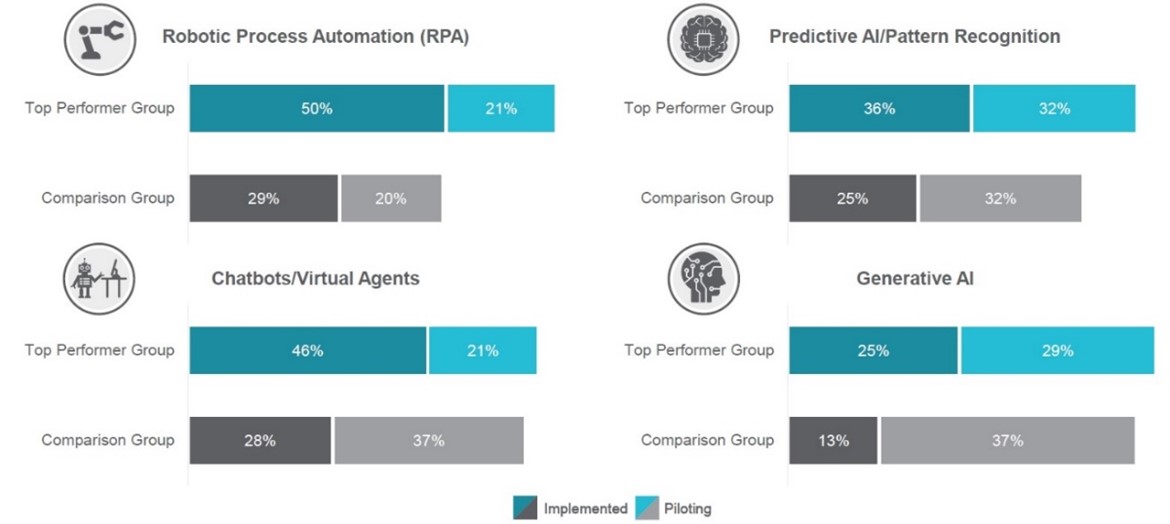

To identify top performing SSOs, ScottMadden selected eight KPIs related to areas including staffing, efficiency, customer service, and cost. SSOs that fall into the top quartile for average scores across all eight KPIs are considered top performers. There were 28 SSOs that met these criteria and 75 in the comparison group (i.e., those not considered top performers).

Top performers outpace the comparison group in many different ways. In addition to having more efficient staffing and lower costs to operate their SSOs, they are more mature with respect to automation and artificial intelligence (Figure 3).

Top performers have implemented automation and AI technologies to a much greater degree than the comparison group. For example, 25% of top performers have implemented generative AI, while only 13% of the comparison group can say the same.

Top Implementation Challenges

When ScottMadden asked respondents about the main challenges they face in adopting predictive or generative AI, the top two challenges were a lack of executive support (29% of respondents) and a lack of organizational buy-in (29%). DeMent said that these challenges help to explain why adoption rates are lower among the comparison group. “Even if generative AI works perfectly, you must be able to explain it to legal departments, internal controls, HR, and other stakeholders to gain approval. Often, the larger hurdle is explaining how AI came to conclusions when the logic is not always traceable.”

Competency challenges are another significant obstacle for many organizations. About a quarter of respondents (24%) said that the availability of technical expertise was their top challenge and 22% identified a lack of internal team capability. These challenges suggest the need for additional talent, whether through internal development and upskilling or acquisition in the external talent market.

Top performing SSOs have found ways to address challenges like a lack of organizational buy-in, executive support, and technical readiness in order to adopt emerging technology to a greater extent than the comparison group.

The Path Forward: Success Factors for Implementation

Overcoming challenges like organizational buy-in and executive support is not enough on its own to implement advanced technologies successfully. There are three critical success factors that also need to be in place for technology to work effectively and drive value for SSOs:

- Standardized processes. Configuring technology for every possible process variation is very difficult and time-consuming. Process standardization is a prerequisite for ensuring that SSOs can work with technology at the appropriate level of scale.

- Quality data. Even the best technology won’t work effectively if data is incorrect, missing, or formatted incorrectly.

- Strong governance. Assigning key roles and responsibilities is critical because it promotes accountability and helps to mitigate risk.

These success factors help to build a strong foundation for the effective use of technology.

Key Takeaways

Technologies like RPA, virtual agents, and AI have already reshaped the shared services landscape in numerous ways. However, many SSOs still face challenges like organizational buy-in that may prevent the adoption of more advanced forms of technology. Specifically, ScottMadden found that:

- RPA is already enabling many components of finance processes and helping SSOs to achieve more efficient staffing as a result.

- While many SSOs have adopted basic AI applications like chatbots, leaders are feeling uncertain about AI capabilities and have not yet developed an AI plan or roadmap.

- Top performing SSOs adopt technologies like RPA and AI to a much greater extent than their peers and competitors.

- Standardized processes, quality data, and strong governance are all critical success factors for the ability to implement new technologies effectively.

About this Research

ScottMadden partnered with APQC to develop and administer a custom study focused on finance shared services that is run on a biennial cycle. The 2024 survey is the seventh cycle of the study (previous cycles include 2014, 2015, 2016, 2018, 2020, and 2022).

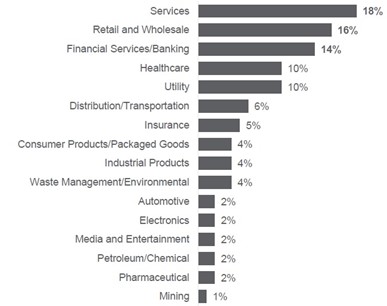

Respondents to the 2024 survey represent 103 SSOs across diverse industries including services, retail and wholesale, financial services and banking, and more (Figure 8).

All participating SSOs are based in the US or Canada and have more than $1 billion in annual revenue (with a median revenue of $12 billion). Almost all (91%) have been operating for three years or longer.

About APQC

APQC (American Productivity & Quality Center) is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management (KM). With more than 1,000 member organizations worldwide, APQC provides the information, data, and insights organizations need to support decision-making and develop internal skills. Learn more.

This content includes median values sourced from APQC’s Open Standards Benchmarking database. If you’re interested in having access to the 25th and 75th percentiles or additional metrics, including various peer group cuts, they are either available through a benchmark license or the Benchmarks on Demand tool depending on your organization’s membership type.

APQC’s Resource Library content leverages data from multiple sources. The Open Standards Benchmark repository is updated on a nightly cadence, whereas other data sources have differing schedules. To provide as much transparency as possible, APQC will always attempt to provide context for the data included in our content and leverage the most up-to-date data available at the time of publication.

About SCOTTMADDEN

ScottMadden has been a pioneer in corporate and shared services and has been helping companies transform their finance and accounting organizations for several decades. Through enterprise financial business services, strategic centers of expertise, intelligent automation solutions, hybrid insource/outsource delivery models, and other solutions, ScottMadden helps organizations increase value for their company. ScottMadden’s clients span a variety of industries from energy to healthcare to higher education to retail. To learn more, visit https://www.scottmadden.com/topic/finance-and-accounting/.