How to determine which framework to use for effective ESG reporting

The prevalence of corporate reporting on environmental, social, and governance (ESG) topics has grown substantially over the past nine years. In 2019, 90% of companies in the S&P 500 published some form of sustainability report, up from a mere 20% in 2011.[1] This increase in reporting has largely been driven by expanded focus from the financial community (e.g., equity investors, debt holders/creditors, insurance companies, etc.) on ESG performance data to better understand the risks and opportunities of specific companies/industries that could impact financial performance. Other stakeholders, such as employees, vendors, and government entities, are also seeking ESG data to evaluate company performance on the topics they view of greatest importance (e.g., diversity of workforce, impact of operations on the local community, etc.).

Given this changing landscape, the question has become less about whether companies should report on ESG topics but rather how they should go about reporting. Investors of all kinds, from large pension and sovereign wealth funds to day traders, are using ESG data when making critical investment decisions. Beyond the interest from the investment community, there are early indications the Biden Administration may develop regulations that require companies listed on U.S. exchanges to disclose ESG metrics, specifically on climate risk and board diversity.[2] Most believe it is a matter of when, not if, publicly traded companies in the United States will be required to report on ESG topics. Furthermore, companies need to balance the increasing demand for ESG data with the costs associated with collecting and reporting this information.

What Changes are Occurring in ESG Reporting?

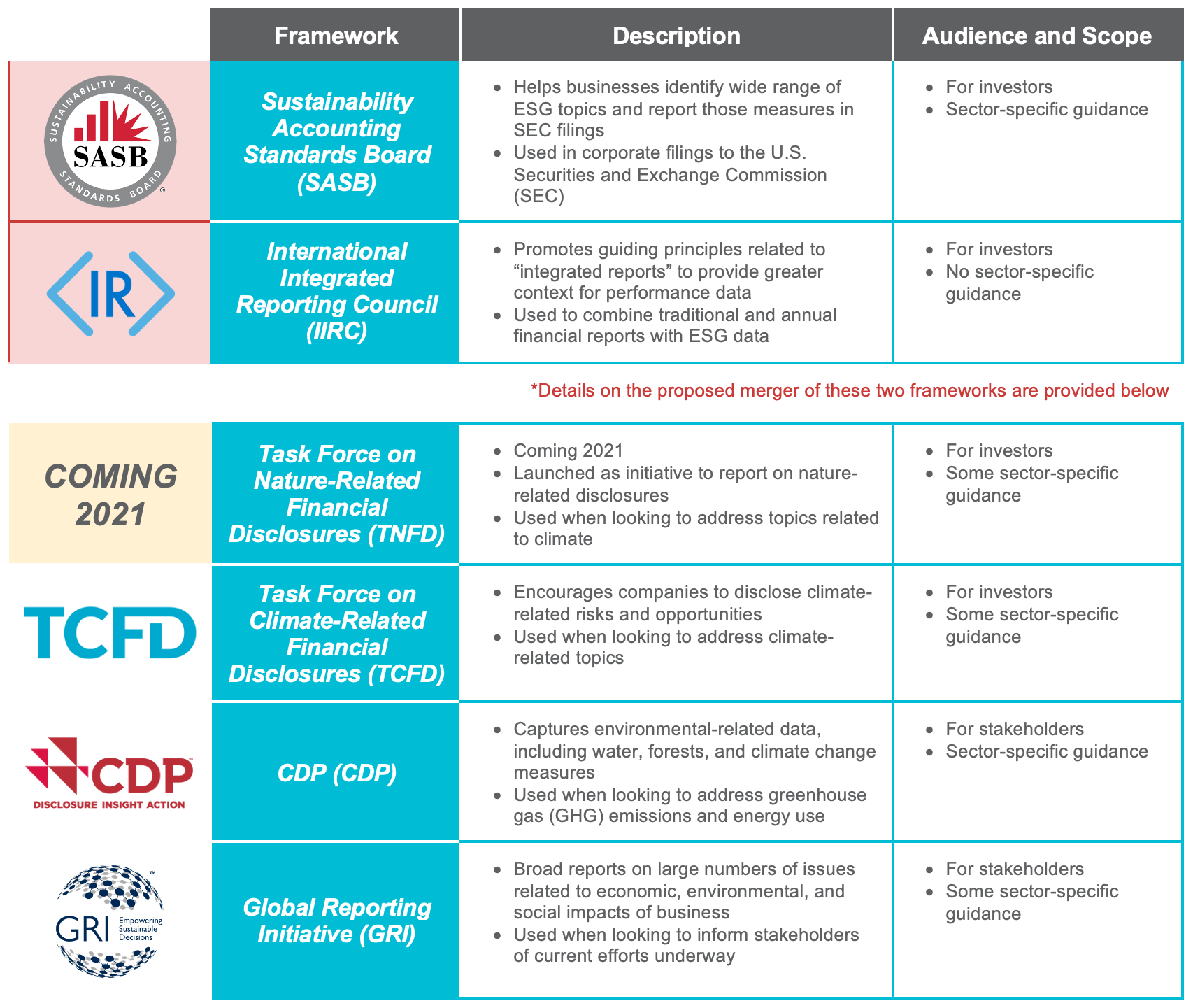

Though the universe of reporting frameworks continues to evolve (more on this shortly), the most common frameworks in the United States are Sustainability Accounting Standards Board (SASB), International Integrated Reporting Framework (IIRC), Task Force on Climate-Related Finance Disclosures (TCFD), CDP, and Global Reporting Initiative (GRI). It is important to remember that not all reporting frameworks are the same. As illustrated in Figure 1 below, each framework has its own unique structure, scope, and target audience.

Figure 1: ESG Reporting Frameworks

The reporting ecosystem continues to evolve. Recent developments include:

- Merger of SASB and IIRC: Last November, SASB and IIRC announced their intention to merge into a single entity by mid-2021. This new entity, the Value Reporting Foundation, is intended to “provide investors and corporations with a comprehensive corporate reporting framework across the full range of enterprise value drivers and standards to drive global sustainability performance.”[3]

- Launch of Stakeholder Capitalism Metrics: At the 2020 World Economic Forum in Davos-Klosters, Switzerland, 120 of the world’s largest companies voiced support for “develop[ing] a core set of common metrics and disclosures on non-financial factors for their investors and other stakeholders.”[4]

- Launch of Taskforce on Nature (TNFD): A partnership between Global Canopy, the United Nations Development Programme (UNDP), the United Nations Environment Programme Finance Initiative (UNEP FI), and the World Wildlife Fund (WWF) was established to develop a framework to report on nature-related disclosures.[5] The framework is expected to be published in 2021.

As expected, the lack of a single reporting framework can be frustrating (not to mention expensive) for companies trying to navigate how best to report ESG performance. There is growing recognition among the various organizations that design and manage these frameworks that increased collaboration on reporting requirements and metrics will make ESG performance data more comparable and relevant (which benefits the financial community and other stakeholders) and easier to collect (which benefits companies).

Which Sustainability Framework Should My Company Use?

For companies interested in reporting on ESG issues, the above frameworks serve as great launching points. When deciding which framework(s) to use, it is important to ask the following key questions:

- What is the focus of our ESG efforts?

- Who is our target audience?

Keep in mind that sustainability frameworks are not mutually exclusive. Companies often report against multiple frameworks or pick and choose components of one framework for inclusion in another. For example, a company that historically used the GRI framework and is interested in reporting more information on ESG topics that may materially impact financial performance, may incorporate elements of newer frameworks, like SASB or TCFD, into their existing reports. While this approach may save time and resources, there is a push in the industry for organizations to ask themselves how they are ensuring the right information makes it to the right audience.

One-size reporting does not fit all. More and more companies are exploring capabilities that allow stakeholders that use company ESG data to build their own customized reports based on information they are interested in (e.g., financial investors may be more interested in evaluating metrics than reading through example case studies). When embarking on the reporting journey, it is vital to keep in mind the target audience(s) and the ESG information they want to see reported.

Though there are multiple reporting frameworks available, SASB (which, after merging with IIRC, will soon become Value Reporting Foundation) and TCFD have responded to recent needs within the investor community to report on ESG issues that have the potential to be materially impactful from a financial and/or risk perspective. This focus on financial impacts has resulted in the financial community requesting companies report their ESG performance using these frameworks.

Developing a comprehensive sustainability report can be daunting. For companies new to sustainability reporting, there a few simple steps that, if done correctly, will establish a solid foundation.

Key Steps for Sustainability Reporting First-Timers

For those new to sustainability reporting, it is important to first get organized and engage the appropriate stakeholders at the beginning of the process. Starting with the steps below will help pave the way for effective and efficient ESG reporting.

Set Goals and Expectations

Linking ESG targets to corporate strategy and business planning is a leading practice that enables organizations to align resources with current efforts and improves chances of achieving ESG goals. Sustainability teams should not set goals and expectations in isolation from company leadership. Support from company leadership provides legitimacy to a company’s sustainability efforts and increases the likelihood that sustainability will be incorporated into overall business strategy. Once goals and expectations are established, metrics should be identified to track progress against those stated goals. Be sure to engage with leaders from groups across the company (typically finance, HR, operations, legal, and risk) in the early stages of target and metric development, as these groups will often be responsible for collecting data required to calculate metrics and reviewing performance. These groups will also support further integration of ESG efforts with everyday operations and hopefully into broader corporate strategy.

For additional information on how to integrate sustainability into corporate strategy, we invite you to read our recent article, “Integrating ESG Issues into Corporate Strategy.”

Benchmark Against Industry Peers

ESG issues come in many shapes and sizes. As ESG issues are often nuanced and vary by industry or region, benchmarking is a powerful tool that should be utilized to understand how your reporting compares to industry peers (or if not currently reporting, what is being reported by peer companies). Better understanding the areas where your company underperforms can help your organization identify gap-closing measures. Understanding the areas where your company performs better against peers can help identify initiatives to highlight and market.

Leverage Internal Resources

Companies often have much of the information needed to populate significant sections of an ESG report, but they may not realize it because the information is not currently being used for this purpose. For example, HR systems typically contain information on employee and leadership diversity that are helpful to ESG efforts and reporting. Understanding what information your organization already has makes it easier to transition to data analysis. Additionally, your organization may have knowledge management systems in place to track ESG data, which may lead to more efficient reporting across departments.

Conclusion

Reporting ESG performance is of ever-increasing importance and may soon become a requirement for publicly traded companies in the United States. However, simply reporting for reporting’s sake is a waste of time, effort, and money. Because there are several reporting frameworks available, companies need to ask critical questions about the purpose of reporting and the intended audience before settling on a specific framework(s). Companies that are thoughtful about their approaches to reporting will not only better engage their internal and external stakeholders but will also set themselves up well for monitoring and managing ESG initiatives.

How ScottMadden Can Help

ScottMadden has experience performing stakeholder assessments, risk analyses, and corporate sustainability projects for a variety of clients, including utilities, public entities, media and entertainment companies, renewable energy developers, and industrial companies. Contact us today to support your ESG strategy and reporting needs.

Additional Contributing Authors: Paul Scarinci

[1] Annual 2020 Flash Report, Governance & Accountability Institute, Inc., July 2020. See also, 2019 Flash Report.

[2] The Biden Administration Is About to Put Its Stamp on Financial Regulation. What Investors Can Expect, Barron’s, February 4, 2021.

[3] IIRC and SASB announce intent to merge in major step toward simplifying the corporate reporting system, SASB, November 2020.

[4] Measuring Stakeholder Capitalism, World Economic Forum, September 2020.

[5] Who We Are, Taskforce on Nature-related Financial Disclosures, December 2020 (last updated).