- Delivery model and operations

- Staffing

- SSO management infrastructure and technology

- Performance

In addition to summarizing key findings related to governance, cost, and staffing, DeMent and Robinson also shared their analysis of the study’s top-performing SSOs and high-level trends related to emerging technology.

Structure and Governance

ScottMadden’s findings related to SSO structure and governance include recent changes in reporting structures, global process governance, and the scope of shared services.

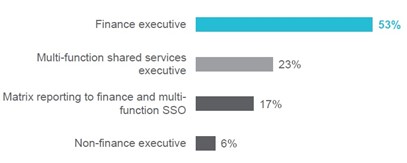

Reporting Structure

A majority of respondents (53%) said that their SSO reports to the CFO or another finance executive. However, over the past decade, SSOs have been trending more toward multifunctional models (for example, leveraging HR shared services in addition to finance). Robinson said that “nearly all of our clients today who are thinking about shared services and want to pursue it are assuming a multifunction target operating model when they get to the end of implementation.” This trend means that SSOs are increasingly reporting to a multifunction shared services executive or using matrix reporting to finance and a multifunctional executive (Figure 1).

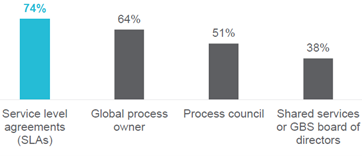

Global Process Governance

Process governance is concerned with roles and responsibilities for process work and is critical for the effective operation of an SSO. Service Level Agreements (SLAs) are the most common approach to process governance (Figure 2).

Robinson noted that as many SSOs mature, they tend to grow less rigid and formal in their approach to managing SLAs. “Those who successfully managed SLAs over time have simplified that approach a bit to make it easier to implement and monitor.” In addition, Robinson said “we’re starting to see phrases like ‘partnership agreements’ or ‘operating agreements’ instead of ‘service level agreements’ as a way to emphasize the connections that are important to make with the business.” Twelve percent of respondents also said that their SSO began by using SLAs but now carry out governance through ad hoc discussions instead.

Scope of Finance Shared Services

While the scope of shared services has remained relatively stable over the past few cycles of ScottMadden’s study, there have been some notable changes this year. In previous years, processes like payroll and accounts payable topped the list of the most common services provided by a finance SSO. While these processes are still near the top, general accounting and financial reporting are now the most common services provided by SSOs (Figure 3). Robinson said this trend reflects growing maturity as many SSOs continue to expand the scope of the services they provide.

SSOs are increasingly providing high value services that have not historically been within the scope of shared services. For example, 75% of SSOs now carry out planning, budgeting, and forecasting.

Cost and Staffing Benchmarks

As part of its study, ScottMadden asked participants about their performance on key measures including the total cost of finance, the cost to operate shared services, and the number of full time-equivalent employees (FTEs) per $1 billion revenue.

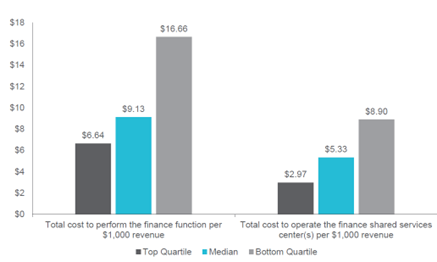

Total Cost of Finance per $1,000 Revenue

At the median, SSOs spend close to one percent of their organizations’ revenue ($9.13 per $1,000) to perform the finance function (Figure 4). Spending around one percent of revenue has been the norm for many years, although SSOs in the top quartile only spend about two-thirds of a percent for the same set of processes ($6.64 or less per $1,000 revenue). Organizations in the bottom quartile spend the most at $16.66 or more.

Cost to Operate Shared Services

At the median, organizations spend $5.33 per $1,000 revenue to operate their finance shared services centers. Organizations in the bottom quartile spend $8.90, while those in the top quartile spend $2.97 (see Figure 4).

The cost to operate shared services has been growing recently, a trend that Robinson says “may indicate growth and increased investment in the shared services model.” As organizations move toward multifunctional models and higher value services, it makes sense that the cost to operate shared services centers will rise as well.

Finance FTEs per $1 Billion Revenue

The number of finance function FTEs per $1 billion revenue is a key efficiency measure both for SSOs and for the finance function more broadly. All else being equal, a lower number is better because it means fewer employees can carry out the same amount of work.

The number of finance employees in an SSO can vary based on factors like industry and size, so it’s important to tread carefully when using this measure for internal benchmarking. At the median, ScottMadden found that SSOs have 65 finance function FTEs per $1 billion dollars in revenue. SSOs in the bottom quartile have 100 finance FTEs per $1 billion revenue, while those in the top quartile have 33.

Top Performer Characteristics

To identify top performing SSOs, ScottMadden selected eight KPIs related to areas including staffing, efficiency, customer service, and cost. SSOs that fall into the top quartile for average scores across all eight KPIs are considered top performers. There were 28 SSOs that met these criteria and 75 in the comparison group (i.e., those not considered top performers).

Top performers have different characteristics than the comparison group. For example:

- Half of the top performer group say they have been operating their SSO for 10 or more years, while only 16% of the comparison group can say the same.

- Top performers are larger in size, with a median annual revenue of $23 billion dollars compared with $9.5 billion from the comparison group.

- Top performers have broader global coverage. More than half (57%) serve more than 10 countries, while only 41% of the comparison group do.

DeMent highlighted key findings about top performers in areas including staffing, process management, and the scope of shared services.

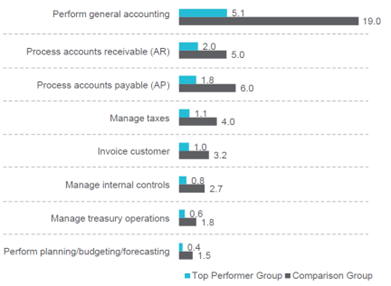

Greater Efficiency in Staffing

Top performers have much greater efficiency than their peers when it comes to staffing. While the comparison group has a median of 76.7 FTEs per $1 billion revenue, top performers only need 25.4 FTEs to manage their SSOs.

Top performers also carry out key finance processes finance with greater efficiency than the comparison group (Figure 5). For example, while the comparison group has 19 FTEs at the median to perform general accounting, top performers only have 5.1 FTEs.

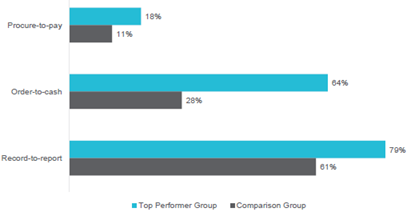

Greater End-to-End Process Adoption

End-to-end (E2E) processes help to promote clarity in handoffs between functions, enable a customer-centric view of processes, and allow management to think in a more holistic way about how processes connect. Relative to the comparison group, top performing SSOs show greater adoption of E2E processes like procure-to-pay, order-to-cash, and record-to-report (Figure 6).

DeMent said that the number of top performers adopting E2E processes has increased over the past few years, while adoption in the comparison group decreased. This trend has a lot to do with the fact that implementing E2E processes can often be a significant challenge. “It’s tough work trying to manage components of an end-to-end process that often span outside of finance to achieve alignment across multiple areas in an organization. Many of the newer SSOs may just be slating for the distant future or having less success, whereas the top performers are often multi-functional, making it a little easier to connect processes across functions,” DeMent said.

Larger Scope for Shared Services

The scope of shared services activity is broader for top performing SSOs relative to the comparison group. For example, top performers are 30% more likely to process customer credit, 18% more likely to perform fixed asset accounting, and 16% more likely to process taxes.

Top performers are also more likely to provide high-value services as part of their SSO. For example, 43% develop tax strategy and planning, versus 36% of the comparison group (Figure 7).

Leaders Are Proceeding Cautiously with AI

Artificial intelligence (AI) and other technologies are reshaping the ways that SSOs carry out their work. For example, chatbots have already seen widespread acceptance, with 66% of organizations either piloting or actively implementing them. Only seven percent of SSOs are not considering this technology. Generative AI is currently the most piloted technology, with 35% of organizations actively exploring its potential.

See Automation and AI in Finance Shared Services: A Competitive Edge for Tomorrow for more data and analysis related to emerging technology in finance shared services.

While many leaders view AI as a high priority for their SSOs, they are still proceeding with caution for now. “Executives know they need to do something and are often directing SSO and global business services (GBS) leaders to look for AI traction. We have found it’s hard to articulate what you want AI to do unless you see it in rapid prototypes. There’s also concern about bias, hallucinations, and the exposure of intellectual property, which can be alleviated by first using AI to generate synthetic (or artificial) data to show wins or fail fast with prototypes. Once organizations have a successful prototype, other governance questions must be addressed such as quality assurance, security, and whether to build or buy,” DeMent said. As a result, “very few SSOs have developed a simple three-year roadmap that clearly describes where they want to go with AI.” While more basic AI applications like chatbots and intelligent automation have already seen wider adoption, generative AI and other technologies may take longer to gain traction.

Key Takeaways

ScottMadden discovered several key trends through its most recent finance shared services benchmarking study:

- Many organizations are gravitating toward multifunctional shared services models, which is also bringing changes to reporting relationships.

- SLAs are still the most common form of governance, but many SSOs are now trending toward less formal and rigid management structures in favor of more collaborative and relational approaches.

- SSOs are increasingly offering high-value services like planning, budgeting, and forecasting within the scope of shared services.

- Top performing SSOs spend less, use fewer staff, and provide more services relative to their peers in the comparison group.

- While many SSOs have implemented chatbots, leaders are moving more slowly with advanced AI applications.

About this Research

ScottMadden partnered with APQC to develop and administer a custom study focused on finance shared services that is run on a biennial cycle. The 2024 survey is the seventh cycle of the study (previous cycles include 2014, 2015, 2016, 2018, 2020, and 2022).

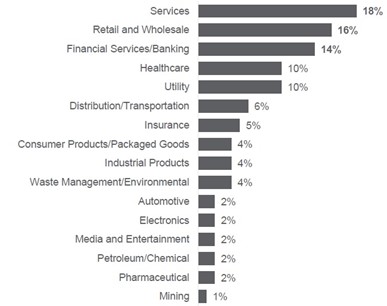

Respondents to the 2024 survey represent 103 SSOs across diverse industries including services, retail and wholesale, financial services and banking, and more (Figure 8).

All participating SSOs are based in the US or Canada and have more than $1 billion in annual revenue (with a median revenue of $12 billion). Almost all (91%) have been operating for three years or longer.

About APQC

APQC (American Productivity & Quality Center) is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management (KM). With more than 1,000 member organizations worldwide, APQC provides the information, data, and insights organizations need to support decision-making and develop internal skills. Learn more.

This content includes median values sourced from APQC’s Open Standards Benchmarking database. If you’re interested in having access to the 25th and 75th percentiles or additional metrics, including various peer group cuts, they are either available through a benchmark license or the Benchmarks on Demand tool depending on your organization’s membership type.

APQC’s Resource Library content leverages data from multiple sources. The Open Standards Benchmark repository is updated on a nightly cadence, whereas other data sources have differing schedules. To provide as much transparency as possible, APQC will always attempt to provide context for the data included in our content and leverage the most up-to-date data available at the time of publication.

About SCOTTMADDEN

ScottMadden has been a pioneer in corporate and shared services and has been helping companies transform their finance and accounting organizations for several decades. Through enterprise financial business services, strategic centers of expertise, intelligent automation solutions, hybrid insource/outsource delivery models, and other solutions, ScottMadden helps organizations increase value for their company. ScottMadden’s clients span a variety of industries from energy to healthcare to higher education to retail. To learn more, visit https://www.scottmadden.com/topic/finance-and-accounting/.