We’ve talked for decades about disruption in the electric and gas industries. We’ve faced “unprecedented challenges,” existential threats, fundamental policy changes, exponential technology growth, extreme weather events, and a changing mix of customer preferences and usage patterns. The vertically integrated electric utility framework of the 1970s has been restructured, fragmented, and recast along asset class boundaries (generation, transmission, etc.), each with different business models, operating frameworks, ownership types, and regulatory oversight. Disruptive threats experienced over the past 50 years have become mainstream and are part of our ongoing dialogue. Is today any different? Given the nature and speed by which major disruptors, such as the clean energy transition, are impacting our industry, it might be.

The disruption caused by the clean energy transition is gaining attention and momentum. Changes associated with today’s clean energy transition are different from the disruptors we have faced historically. In previous decades, we saw single elements of the energy value chain, such as generation or transmission, “in the news” at any given time.

Today, we face disruptive threats that impact all aspects of our integrated energy system at the same time and increase the interdependence we see across electric and gas systems.

These changes shift the paradigms for utility investment and require new ways of thinking about the physical systems (wires and pipes), the new business and financial models that underlie such investments, and the impacts and opportunities such changes afford our customers and our shareholders.

Dealing with disruptive threats and identifying the opportunities that may stem from them is not a new concept. Most companies are experiencing, or have experienced, some level of disruption. How industry leaders respond and react to today’s disruptors, while identifying and seizing opportunities offered by tomorrow’s disruptors, is a crucial measure of success for electric and gas industry leaders. Transformational change is inevitable; leadership is more critical than ever.

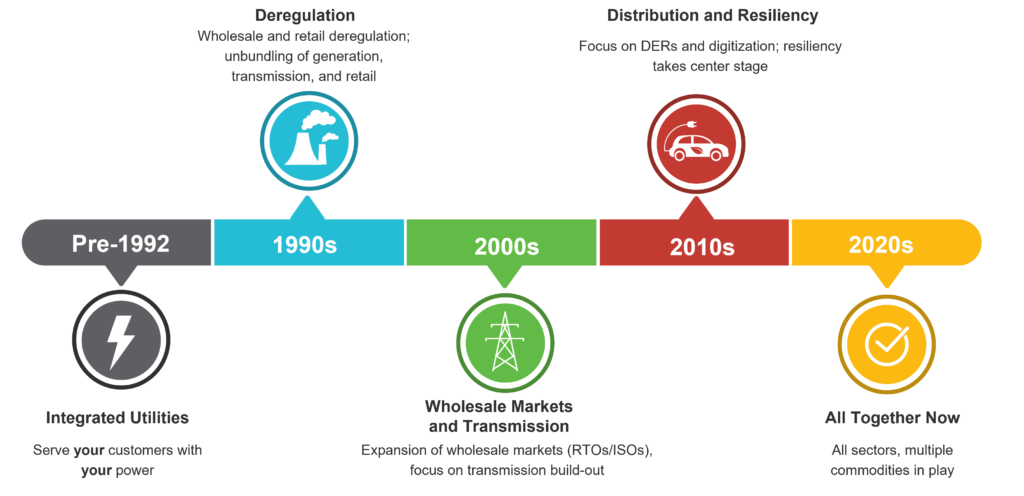

Historical Disruptors Were Challenging but Limited in Scope

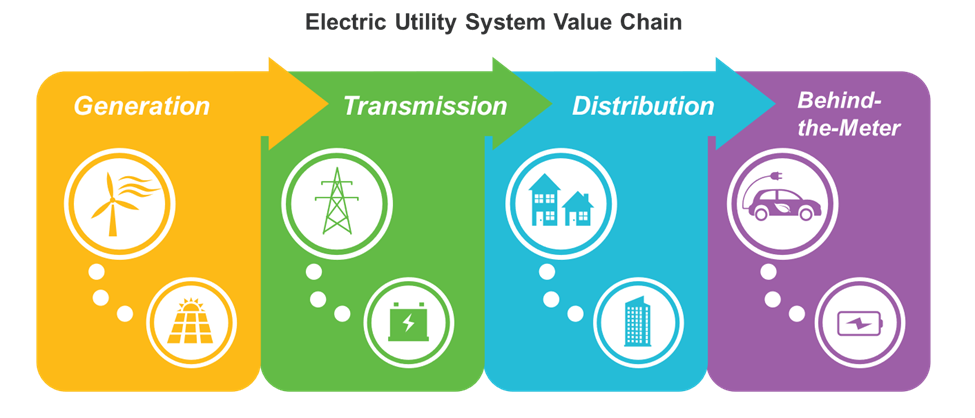

A brief history lesson. Significant changes to the electric and gas utility business and operational models and markets have historically surfaced in a single element of the utility value chain at a given time, as depicted in the graphic below.

Historical Disruptions Have Generally Impacted Single Elements of the Electric Value Chain at a Given Time

During the 1970s, utilities managed all generation/production and load within their respective service territories. Single-control centers monitored and dispatched generation and operated the transmission grid within an integrated area. The vertically integrated utility planned, constructed, and managed all physical assets, from generation through customer metering, to ensure safe, reliable power for customers.

Shortages of natural gas, the 1973 oil crisis, and the growth of environmentalism all contributed to the 1970s being a pivotal decade. Legislative acts such as the Energy Policy and Conservation Act of 1975, the establishment of the Department of Energy (DOE) in 1977, the Natural Gas Policy Act of 1978, and The Public Utilities Regulatory Policies Act of 1978 (PURPA) set the stage for dramatic changes in generation, including a focus on non-fossil fuel generation, energy conservation, and the establishment of a new category of power plants—independent power producers (IPPs). IPPs could sell wholesale power to utilities without having a “service territory.”

During the 1980s, disruption of nuclear power plant construction brought unprecedented challenges to utilities. Nuclear plants had in part been commissioned in light of the 1970s oil shocks. However, slowing electric demand, long-lead times for nuclear plant permitting and building, high-construction costs, and public opposition (galvanized by the 1979 Three Mile Island plant incident) contributed to the cancellation of 67 planned nuclear builds from 1979 through 2013. Not a single reactor began construction between 1978 and 2013.

Utility energy efficiency and demand side management programs that arose during the late 1970s increased in the 1980s. The substitution of customer end-use energy efficiency savings as an alternative generation source significantly impacted utility resource planning, operations, business models, pricing and tariffs, and regulatory practices. The American Council for an Energy-Efficient Economy’s (ACEEE) research showed that electric utilities spent close to $2 billion per year on customer electric energy efficiency programs by the early 1990s.

During the 1990s, the restructuring and deregulation of natural gas production, interstate transportation, and the unbundling of wholesale power transmission service and transmission access took centerstage. In some regions, wholesale markets were formed to manage transmission access and wholesale transactions. Wholesale deregulation led to competitive wholesale electricity markets, performance-based regulation, and electric retail deregulation. The unbundling of generation, transmission, and retail services in many states effectively disrupted the vertical operation of utilities and the integrated resource plan (IRP) supporting them.

During the 2000s, the growth of IPPs, wholesale transmission service, and wholesale electricity markets fueled the need for transmission to facilitate access to the new generation plants. The creation and growth of regional transmission organizations (RTOs) and independent system operators (ISOs), the economics of dispatching generation across the RTO/ISO footprints, and the growth in transmission investment (a five-fold increase from 1997 to 2012) gave rise to new transmission business models and investment incentives. Market participation was voluntary.

During the same period, the broad expansion of smart meters and a general decline in energy usage fueled the growth of new customer-focused pricing models, programs, and energy payment services. These changes continued into the 2010s and, together with declining technology costs, contributed to the emergence of distributed energy resources (DERs) and the need for a modernized distribution grid.

During the 2010s, the rapid growth in renewable energy resources (solar, wind) and DERs, the shale gas revolution spurred a power plant building frenzy, and the mounting costs and liabilities from climate-related disasters grabbed the headlines. The rise in the industrial internet of things, digitization, big data, and predictive analytics complemented the increase in distribution generation assets. California’s wildfires and the polar vortex in New England highlighted the vulnerability of electric and gas utility service, the need to improve reliability and resiliency, and the high costs of repairing and replacing aging infrastructure.

As we enter the 2020s, the landscape that electric and gas utilities find themselves is dramatically different from the landscape 50 years ago. Today we have a mix of vertically integrated utilities, generation and transmission cooperatives, transmission or local distribution-only companies, non-traditional load-serving entities, and competitive wholesale suppliers. We have moved from a model where a single company manages the assets of a vertically integrated utility to one in which multiple companies may participate in the various elements of the value chain. Differences across states and markets mean that different customers are served by very different models.

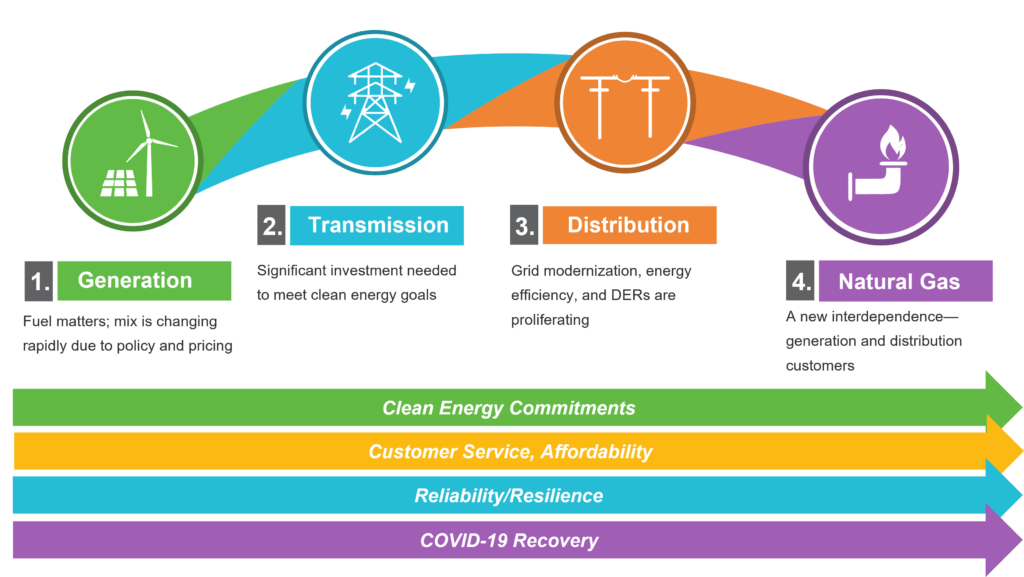

Today’s Disruptions Are Impacting the Entire Value Chain

Today’s challenges are driving fundamental change in every aspect of the value chain from generation and production to behind-the-meter distributed generation. The rapid transition to a carbon-free future is forcing difficult choices for policymakers, regulators, and utilities. For electric utilities, as policy priorities related to clean energy, electrification, and management of customer bill impacts drive change in each part of the value chain, it makes choosing the “correct” policy or investment more difficult.

Prioritizing Utility Capital Spending Is Growing More Difficult

Utilities prioritize capital spending across various capital upgrade options in electric and gas assets, IT systems, and facilities (to name a few). The industry has developed market and regulatory constructs by which the prioritized investments are funded. Within each aspect of the value chain, there is a framework for assessing risks and benefits of investments.

For instance, generation asset decisions for integrated utilities are made within the context of an IRP, generally through scenarios that assess anticipated generation demand, cost, and, increasingly, carbon-reduction goals. For transmission, investments are assessed based upon the ability to meet NERC’s planning and operating criteria and cost. This effort is expanded in an RTO/ISO context based on broader regional planning, market efficiency, and the generation mix. In the case of distribution-level investments, reliability, safety, and cost-effectiveness have generally guided priorities. However, companies (and regulators) are beginning to consider distribution investment frameworks that add other criteria, such as environmental metrics and portfolio and system resiliency.

Natural Gas

Electrification has important implications for the future of the natural gas system. There is a level of gas/electric interdependency emerging at the customer level that has not been seen in the industry before, as electrification will have a direct impact on both natural gas and electricity usage.

Starting with the polar vortex of 2014 (and before that), we saw the challenges emerge as gas LDCs and merchant generators both relied on the supply of natural gas amid record low temperatures. The February 2021 Winter Storm Uri highlighted this issue, leading to blackouts not seen since the Northeast blackout of 2003. February events showed the system’s vulnerability to events impacting both electric and gas systems. Operational interdependence is not new. Electric and gas interdependence has been studied across the country as it pertains to this wholesale issue.

As electrification initiatives and natural gas bans emerge on the policy front, electric and gas utilities will need to contemplate the potential impacts of this shift across commodities.

Even within the electric utility ecosystem, challenges arise when aligning and prioritizing generation, transmission, and distribution investments to support clean energy goals. Discrete solutions made within the context of a specific asset class may not consider unintended impacts or the relative importance and cost of the solution across all value chain elements. In the case of assets owned by different entities, prioritization across asset classes is becoming nearly impossible. (Think transmission and distribution owned by different companies, generation that has been divested, or a separate gas company.)

In addition, states are now getting involved by supporting long-term power purchase agreements, which have the potential to distort market signals. In organized markets, different asset owners would likely only focus on their own investments, resulting in a lack of coordination across disparate assets and their owners.

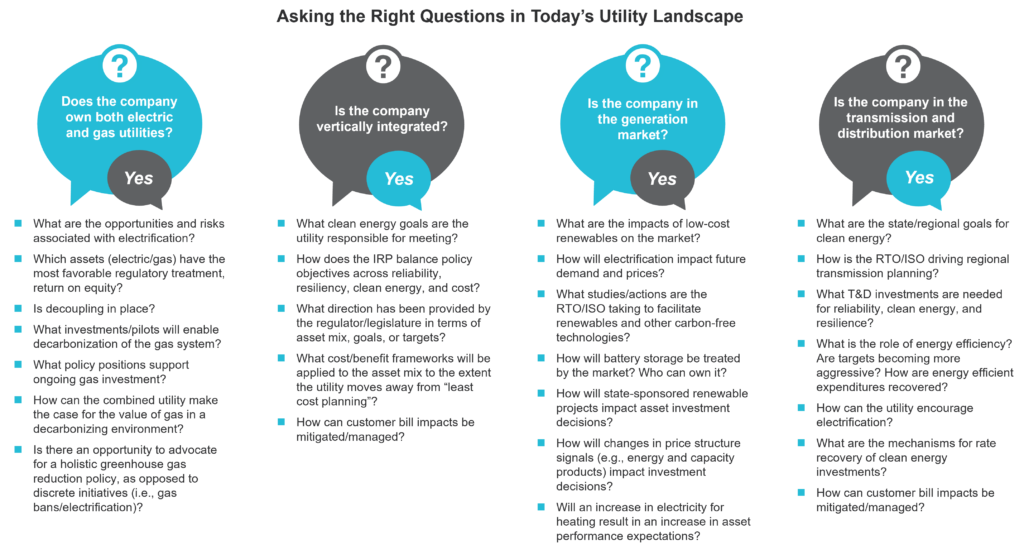

A New Framework Is Needed to Assess and Make Decisions

Traditionally, utility performance and investment assessment are measured across three components: safety, reliability, and cost-effectiveness. The introduction of federal and state policy objectives regarding carbon-emission reduction targets and responsiveness of the energy delivery chain to disruptive events results in more than doubling the criteria to seven with the addition of resiliency, decarbonization, affordability, and equity. The time required to develop, vet, approve, and execute these decisions has increased dramatically.

As we add criteria beyond safety, reliability, and cost-effectiveness to focus on “clean” resources and resiliency, regulators and policymakers are at risk of locking in technology or programs that may prevent the inclusion of other more cost-effective, resilient, and “clean” technology breakthroughs or innovation at a later point. Given the increasing complexities regarding asset prioritization and assessment coupled with evolving policy changes and compliance issues, asking the right questions to frame the problem is a critical first step.

As the industry considers the clean energy transition, the various participants in the value chain, as shown above, will have different perspectives. The following attributes will matter and, more importantly, will drive behavior:

- Market structure – retail choice, wholesale competition, integrated utility

- Planning approach – IRP; discrete system prudency review

- Business lines – gas, power, pipes, wires, generation

- System age – the immediacy of investment needs

- Financial condition – balance sheet strength; availability of capital

- Regulatory environment – constructive/challenging; activity of intervenors; the immediacy of regulation/legislation

- Customer profile – customer mix; customer growth; the local economic situation

Utilities will need to study and articulate the trade-offs between potential changes in the system (e.g., cost vs. emissions vs. reliability, etc.) and work with regulators and customers to develop objective, quantifiable criteria for decision making that will facilitate review and approval of decisions. Coordinated planning across utilities may be needed where the customer is served by different companies for electric and gas service. Constructive stakeholder engagement could also facilitate regulatory review of asset investment.

Technology (e.g., battery storage) availability, cost, and performance, current and prospective, will be essential to master, including flexible options and short-term, lower cost bridging strategies. As utilities consider strategies and discrete investments, they will need scenario-based planning models to identify low-regrets decisions and consider how a decision may result in a defined path that precludes other options.

Transformational Change Is Coming – Are We Ready?

The disruption caused by the clean energy transition across the value chain is gaining attention and momentum. These changes are shifting the paradigms for utility investment, requiring new thinking about how to analyze the physical system (wires and pipes). It will also necessitate the review of financial impacts, regulatory constructs, and criteria for investment decisions. As these regulatory constructs change to support different types of investments, utilities may need to advocate for customers with a view to potential bill impacts. This customer-focused view will be fundamental in places where portions of the value chain are disaggregated and the utility does not own all the assets or activities that comprise the customer’s bill.

Dealing with disruptive threats has been a hallmark of the electric and gas utility industry. However, the challenges faced today are different in terms of their scale and breadth of impact. Leaders of electric and gas utilities must seek to make the appropriate investments in their systems in a timely fashion considering more variables and more possible outcomes.

Establishing a new framework for making decisions, developing a more focused situational assessment, understanding the relative market position within the state or region, and carefully qualifying the appetite for risk are the responsibilities of our leaders today.

Transformational change is inevitable; leadership is more critical than ever.