- Delivery model and operations

- Staffing

- SSO management infrastructure and technology

- Performance

Drawing from the results of the survey, this article summarizes the study’s findings related to governance and global models in finance shared services.

Governance Practices

Service Level Agreements Are Evolving

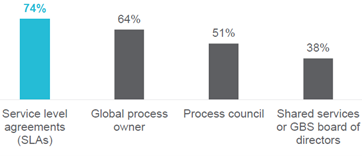

A service level agreement (SLA) is a contract between a service provider and its client or customer that specifies the services to be provided and the measures or KPIs to which the provider will be held accountable. SLAs are the most common approach to global process governance for SSOs (Figure 1). About three-quarters of respondents (74%) say they use this approach, the highest percentage since 2018.

In addition, Robinson said that many SSOs have been moving away from using rigid and formal language like ‘service level agreement’ in favor of more relational language. “We’re starting to see phrases like ‘partnership agreements’ or ‘operating agreements’ instead of ‘service level agreements’ as a way to emphasize the connections that are important to make with the business.” Another 12% of respondents said that their SSO began by using SLAs but now carry out governance through other mechanisms.

Top Performing SSOs are More Likely to use Global Process Owners

A process owner is an individual who is accountable for change management, training, monitoring and control, and continuous improvement for their respective process or processes. An end-to-end or global process owner is a single-point owner responsible for managing an end-to-end process across an enterprise. Identifying an owner for each process ensures that someone is directly accountable for managing performance, mitigating risk, and identifying opportunities for process improvement.

About two-thirds of all respondents (64%) use process owners as an approach to global process governance. ScottMadden also found that top performing SSOs are more likely to use global process owners than their peers and competitors. Almost three-quarters (71%) of top performers leverage the global process owner role, while 61% of the comparison group do. (See “About This Research” for more information on the study’s top performers and the comparison group).

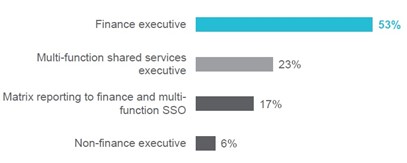

Reporting Relationships are Becoming More Multifunctional

A majority of participants said that their SSO reports to the CFO or another finance executive. However, over the past decade, SSOs have been trending toward multifunctional models (for example, leveraging HR shared services in addition to finance). Robinson said that “nearly all of our clients today who are thinking about shared services and want to pursue it are assuming a multifunction target operating model when they get to the end of implementation.” This trend means that SSOs are increasingly reporting to a multifunction shared services executive or using matrix reporting to finance and a multifunctional executive (Figure 2).

Global Models

Participants that use the GBS model are evenly split across those that have:

- Regional centers with global integration (21% of participants)

- A single global center (20%)

- Site-specific centers with global integration (20%)

Participants that do not use a GBS model are split between those with independent regional centers (20%) and those with local site-specific centers (17%).

A large majority of participants (83%) reported that their SSOs serve more than one country. Almost half (46%) serve 10 or more, which “indicates the true scale that can be achieved with this model,” Robinson said.

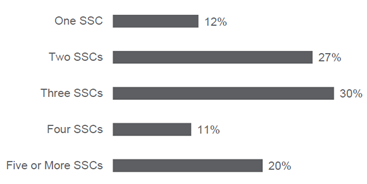

A large majority (88%) also said that they have more than one shared service center (Figure 3), with a fifth of participants saying they operate five or more.

Key Takeaways

- Top performing SSOs are also more likely than others to identify global process owners as a form of governance.

- Many organizations are gravitating toward multifunctional shared services models, a trend which is also bringing changes to reporting relationships.

- The growth of organizations using a GBS model has leveled out over time as some organizations tried and failed to implement this approach successfully. Strong governance and leadership support are critical but also difficult for many organizations to achieve.

About this Research

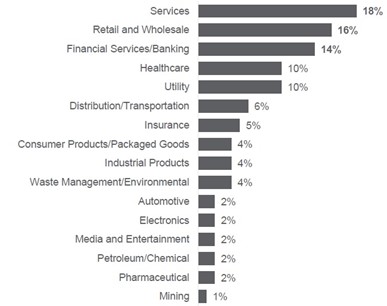

Respondents to the 2024 survey represent 103 SSOs across diverse industries including services, retail and wholesale, financial services and banking, and more (Figure 8).

About APQC

APQC (American Productivity & Quality Center) is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management (KM). With more than 1,000 member organizations worldwide, APQC provides the information, data, and insights organizations need to support decision-making and develop internal skills. Learn more.

This content includes median values sourced from APQC’s Open Standards Benchmarking database. If you’re interested in having access to the 25th and 75th percentiles or additional metrics, including various peer group cuts, they are either available through a benchmark license or the Benchmarks on Demand tool depending on your organization’s membership type.

APQC’s Resource Library content leverages data from multiple sources. The Open Standards Benchmark repository is updated on a nightly cadence, whereas other data sources have differing schedules. To provide as much transparency as possible, APQC will always attempt to provide context for the data included in our content and leverage the most up-to-date data available at the time of publication.

About SCOTTMADDEN

ScottMadden has been a pioneer in corporate and shared services and has been helping companies transform their finance and accounting organizations for several decades. Through enterprise financial business services, strategic centers of expertise, intelligent automation solutions, hybrid insource/outsource delivery models, and other solutions, ScottMadden helps organizations increase value for their company. ScottMadden’s clients span a variety of industries from energy to healthcare to higher education to retail. To learn more, visit https://www.scottmadden.com/topic/finance-and-accounting/.