As the electric power industry navigates passage through the most significant era of transition since its origin, key questions regarding reliability are emerging. Most importantly, can the industry continue to offer the near-certain level of reliable service that is among its modern day hallmarks? And if not, what are the implications?

What is Grid Reliability?

The North American Electric Reliability Corporation (NERC), a non-profit organization whose mission is to assure the reliability of the bulk power system, defines reliability[1] as follows:

Adequacy: The ability of the electricity system to supply the aggregate electrical demand and energy requirements of the end-use customers at all times, taking into account scheduled and reasonably expected unscheduled outages of system elements.

Operating Reliability: The ability of the bulk power system to withstand sudden disturbances, such as electric short circuits or the unanticipated loss of system elements from credible contingencies, while avoiding uncontrolled cascading blackouts or damage to equipment.

These technical definitions are focused on availability of generation capacity to match demand and on the durability of the transmission and distribution system. But to the typical electric utility customer, grid reliability has a much simpler meaning. With only rare exceptions, such as the occasional summer thunderstorm, the electric service is expected to work and the lights to always turn on.

It is clear that this “always on” level of service is changing right before our eyes. There appear to be at least two reasons why.

Drivers of Change

As we look more closely at events in the electric power industry in recent years, there are two key drivers of change currently at work with respect to grid reliability. These are: (1) the increasing frequency of severe weather events and (2) changes in the makeup of the generation fleet itself.

Severe Weather Frequency

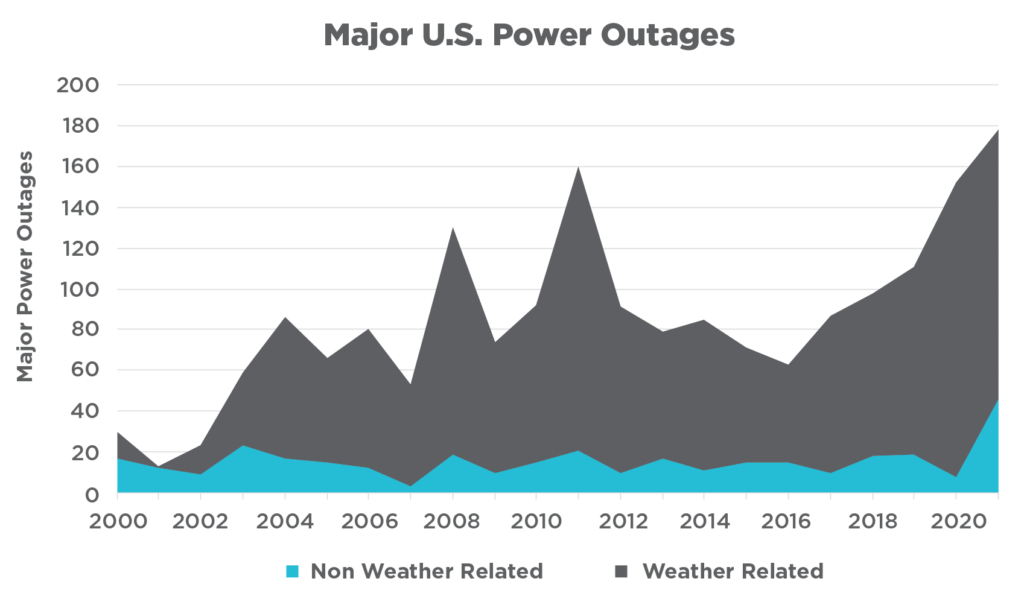

The chart below illustrates major U.S. power outage events impacting at least 50,000 customers for the period 2000 to 2021.

Non-weather-related events, as shown in blue, have remained at a steady state level over this period. However, weather-related events clearly indicate a strong upward trend. In fact, an analysis by Climate Central[2] shows that the average number of major power outages due to severe weather increased by 78% in the period 2011 to 2021 as compared to 2000 to 2010.

A review of other electric reliability industry metrics including those for average outage duration, System Average Interruption Duration Index (SAIDI), outage frequency, and System Average Interruption Frequency Index (SAIFI) shows similar upward trends.[3]

However, one only needs to look back at the recent experience of large-scale severe weather events to recognize how this development is impacting the electric power industry. Consider the following:

- 2012 – Hurricane Sandy made landfall in New Jersey and New York and resulted in power outages for 8.2 million customers across multiple states in the Northeast and Midwest.

- 2014 – A polar vortex event brought extreme cold temperatures across most of the eastern United States. More than 35,000 megawatts of generating capacity became unavailable due to the storm and cold temperatures.

- 2020 – Hurricane Laura made landfall in Louisiana, dropping almost 12 inches of rain and resulting in multi-state power outages impacting 750,000 customers.

- 2021 – Winter Storm Uri caused power outages in Texas and throughout the central United States for 4.5 million customers. The storm was also blamed for 210 deaths.

- 2022 – Winter Storm Elliott caused Duke Energy, LG&E/Kentucky Utilities, and TVA to resort to rolling blackouts, each for the first time in its operating history.

These storms were extraordinarily large, impacting electric service in multiple states, and highly unpredictable, giving electric utilities only days and hours to prepare.

Changing Grid

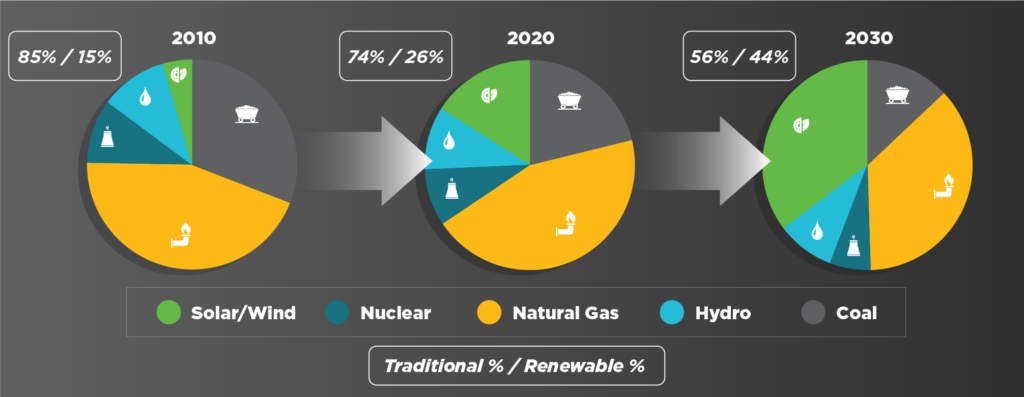

The second driver of change in grid reliability is the rapidly evolving composition of generation assets that serve load. For more than a decade, the U.S. generation fleet has been replacing traditional baseload generation assets, like coal and nuclear, with natural gas and renewable forms of generation, primarily solar and wind.

U.S Generation Fleet Capacity by Fuel (MW)

As shown in the chart above, in 2010 the split was 85% traditional generation capacity and 15% renewables including hydropower. By 2020, the split had moved to 74% vs. 26%. By 2030, it is forecast that the generation portfolio will be made up of 56% traditional generation and 44% renewables. This means that in only two decades the ratio of traditional generation to renewable generation will decline from a ratio of 5.7:1 to 1.25:1.

Through this transition to a cleaner generation fleet, grid managers are losing some of the operating and stability benefits that are inherent in baseload and dispatchable generation. The United States is preparing to add tens of thousands of megawatts of battery storage capacity, which can provide firming qualities to renewables. However, this storage still lags far behind the hundreds of thousands of megawatts of renewables that are now operating.

Importantly, the industry is learning that traditional generation, especially natural gas, is not always able to perform in extreme winter weather. Almost one quarter of PJM’s fleet,[4] including both natural gas and coal, was unable to respond when dispatched during Winter Storm Elliott. Similarly, natural gas transportation was identified as a key cause of outages during Winter Storm Uri. If left unaddressed, these challenges will become more frequent over time due to the common mode failure of widespread reliance on a single fuel source that itself is challenged in terms of building out infrastructure.

Sounding the Alarm

In response to these changes and the apparent overall direction of the electric grid, NERC and independent system operators are already sounding the alarm.

In its 2022–2023 Winter Reliability Assessment, NERC identified areas across North America that it viewed as “highly vulnerable to extreme and prolonged cold weather” noting that load-shedding could be required. The affected areas were extensive, including large and heavily populated portions of the Northwest, ERCOT, MISO North and South, SERC, and New England.

and prolonged cold weather” noting that load-shedding could be required. The affected areas were extensive, including large and heavily populated portions of the Northwest, ERCOT, MISO North and South, SERC, and New England.

This was followed by NERC’s most recent long-term reliability assessment in which it stressed the need for grid operators to assess not only capacity but also energy risks. These included risks to natural gas supplies during extreme winter events as well as the weather dependence of solar and wind assets that have proliferated in certain regions, including ERCOT and SPP.

The PJM Interconnection, which serves 65 million customers across the Mid-Atlantic and Midwest, issued its Energy Transition report in early 2023. The report detailed a combination of continuing load growth, a forecasted 40,000 megawatts of planned retirements, and what it viewed as less than adequate pace of development to replace these retiring assets. It warned of declining reserve margins by the end of the decade for the first time in its history.

Finally, in May 2023, two FERC commissioners warned of a looming reliability crisis in testimony before the U.S. Senate Committee on Energy and Natural Resources. Commissioner Mark Christie said, “I think the United States is heading for a very catastrophic situation in terms of reliability.”[5]

What are the implications?

As our electric system proceeds toward a cleaner future, utilities and grid operators should recognize that the certainty of service reliability is being challenged. This recognition brings with it major implications and the need to prepare for a new set of requirements. Among these, utility leaders should consider improvements and preparation in the following areas:

- Emergency Response – Emergency procedures and planning should be modernized with recognition of the greater frequency of extreme weather events and tighter operating conditions that are already emerging in the electric industry. Roles and responsibilities, internal communication channels, and specific conditions that initiate emergency operations are only a few of the numerous details that should be planned, well-documented, and made readily available including through workforce training.

- Weatherization and Hardening – Despite repeated industry experience, electric utilities continue to be disappointed by the performance of their generation fleets during extreme winter weather events. Too often, generation owners are finding that winter certification programs are not robust enough to ensure operating response of plants when most needed. Changing future performance during extreme conditions will require greater focus and program management oversight of the numerous components that can bring down a plant at the most critical time. Transmission and distribution systems should similarly be assessed for potential vulnerabilities that may render components unavailable or difficult to recover during high stress operating conditions. Increasing frequency of severe weather, for example, will strengthen the economic case for undergrounding of distribution lines in areas that have previously been on the margin.

- Real-Time Customer Communications – Aside from returning electric service, little is more important during a large-scale outage than accurate and timely communication with customers. Today, many utilities simply are not prepared to gather and translate control room and field operating status information during an emergency event into clear communication updates that allow customers to stay current and anticipate restoration. Refining these emergency communication processes can be among the highest impact improvements utilities can make.

- Alignment of Gas and Electric Portfolios – For more than a decade, the industry has struggled with electric/gas interdependence and vulnerabilities presented during large-scale weather events, most recently with Winter Storms Uri and Elliott. Generation owners should carefully examine forecasting and other risks associated with natural gas supply and transportation and develop mitigation strategies.Further, the trend toward electrification is demanding that utilities rebalance gas and electric portfolios as a key component of maintaining future reliability. The interdependencies of the electric system with the natural gas system point to the need for greater coordination and alignment across planning processes, both at the wholesale and retail levels.

The electric power industry is undergoing an extensive transition as it seeks a cleaner future. It is becoming clear that this transition will present ongoing challenges to utilities, generation owners, and grid operators in maintaining the high levels of reliable service that customers have learned to expect over decades of experience. Now is the opportunity for industry leaders to recognize these challenges and implement improvements to address the implications.

[1] NERC Reliability Terminology, August 2013

[2] U.S. EIA Table 11.1 Reliability Metrics of U.S. Distribution System

[3] Surging Weather-Related Power Outages, Climate Central, September 2022

[4] PJM Winter Storm Elliott Overview, January 2023

[5] 2 FERC members flag grid reliability concerns during U.S. Senate Committee hearing, S&P, May 2023