Energy is front-page news in Australia.

In November 2022, ScottMadden joined the Smart Electric Power Alliance and a group of utility executives to understand the impact of the clean energy transition on Australia’s electricity markets.

One morning, the headlines in the local newspaper offered a wide-ranging tour of the country’s clean energy journey.

There was no need to even open the newspaper. An article on the front page decried the implications of pending national policies on the gas industry.

A separate article described the challenges and benefits of increasing solar adoption. A few pages later, public notices announced comment periods for two-generation projects—a coal plant expansion and a new wind farm.

And finally, the opinion section raised questions about reliability challenges associated with retiring baseload generation.

Despite the vegemite sandwiches, it felt like home. Many of these articles could have easily been written about the state of the U.S. energy industry.

Small World: Different Hemisphere, Similar Trends

The energy market in Australia includes many characteristics found in the United States—rapidly growing distributed energy resources, significant retirements of baseload generation, and growing investment in clean energy and grid technologies.

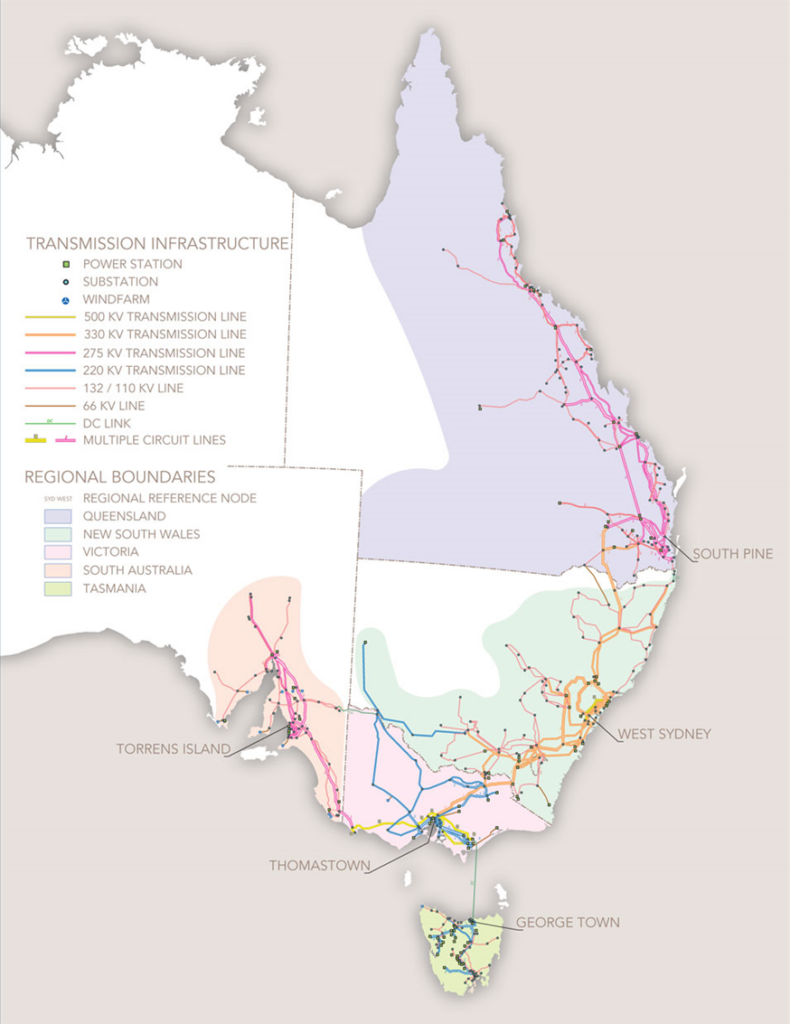

Most Australians reside on the eastern and southeastern coasts and are connected to the National Electricity Market (NEM)—one of the longest interconnected power systems in the world.

The NEM spans five interconnected states that also act as price regions: Queensland, New South Wales (including the Australian Capital Territory), South Australia, Victoria, and Tasmania.

National Electricity Network (NEM)

Market participants in the NEM include generators, transmission networks, distribution networks, energy retailers, and customers.

Generators have traditionally relied heavily on coal. In 2021, coal accounted for over half of electric generation—down from 83% in 2000. The reliance on coal is not surprising given the country’s vast resources and the size of the mining industry in Australia, which accounts for roughly 10% of GDP.

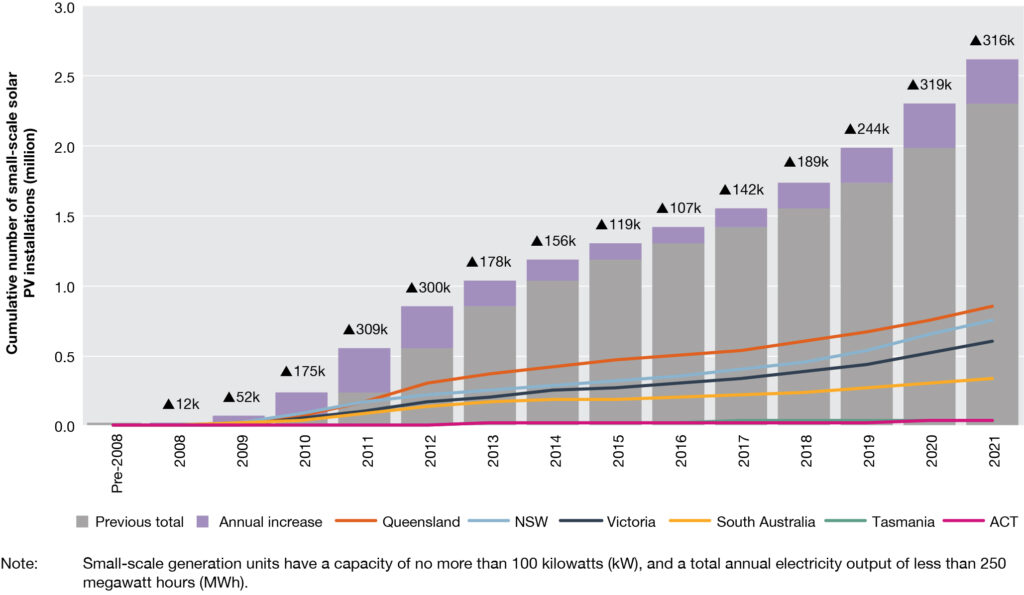

Conversely, a combination of policy, extremely favorable economics, and ease of interconnection has made rooftop solar exceedingly popular among end-customers. In January 2022, over 2.6 million households and businesses in the NEM had installed rooftop solar PV systems.

Small-Scale Solar PV Installations

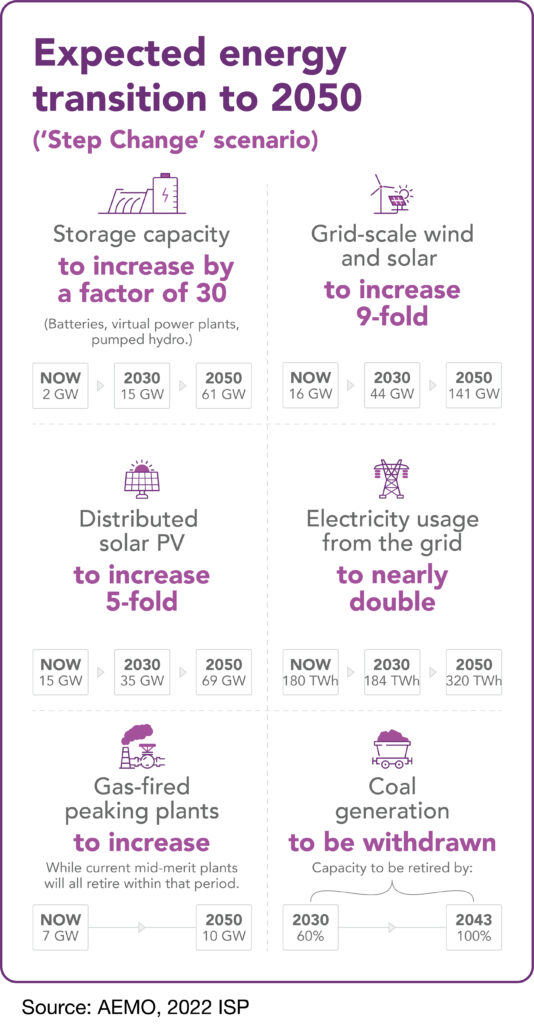

These dynamics capture the early stages of the energy transition underway in Australia. The electric sector is preparing for significant changes following the passage of federal climate legislation in September 2022.

The new law codifies Australia’s national greenhouse gas (GHG) emission reduction targets. Federal policy now requires the country to reduce net GHG emissions to 43% below 2005 levels by 2030 and to zero by 2050.

The factors driving the energy transition do not end with federal policy. Within the NEM, states have worked to deregulate regional retail markets, and each state faces unique challenges in tackling the energy transition.

The similarities with the United States are striking. Utilities find themselves in the middle of varying state and federal policy requirements and growing public demand for clean energy. Even more telling—and concerning—is public policy demands are spurring growing operational challenges.

Stuck in the Middle: Utilities Keep the Lights On

Grid operators in Australia face a daunting challenge. They are tasked with keeping the lights on during a once-in-a-century transformation driven by both top-down and bottom-up pressures.

At the center of the energy transition is the Australian Energy Market Operator (AEMO). As the system operator for the NEM, the AEMO coordinates day-to-day energy market operations.

In addition, the AEMO is planning for a future system that relies primarily on renewables, storage, and transmission. With many coal generators nearing end of life, and public pressure to retire them more quickly, the transition to other sources of generation is increasingly urgent.

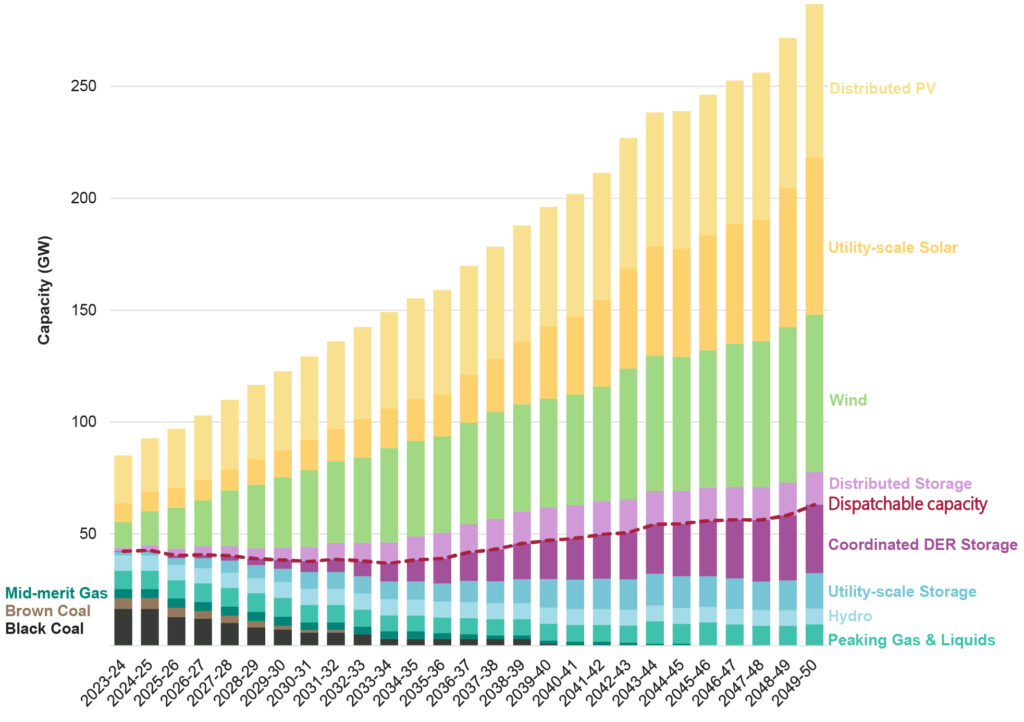

In response, the AEMO developed its Integrated System Plan (ISP) outlining the transition of resources needed to meet the country’s net-zero targets—Australia’s long-term roadmap for the energy transition.

The ISP also highlights the development of renewable energy zones, which will combine generation, storage, and the transmission that will be needed in specific parts of the country.

NEM Forecast Capacity to 2050, Step Change Scenario

However, given the speed of the transition, there is concern that market forces will fail to produce the needed infrastructure in a timely manner.

In response, the AEMO formed a subsidiary, AEMO Services. Operating initially in New South Wales, AEMO Services will run competitive solicitations to support resource development; a model which could be replicated in other states.

These planning efforts are taking shape while operational challenges are emerging at the wholesale level. The most notable example is the suspension of market operations for multiple days in 2022 following extreme cold weather.

The actions were required due to a confluence of events that included high commodity prices, domestic market price caps, planned and unplanned outages of generating plants, low output from semi-scheduled generation, and abnormally high demand.

Operational challenges are also emerging at the retail level. For example, rooftop solar PV expanded significantly in Victoria following the implementation of the Solar Homes Initiative. This, combined with the region’s high solar irradiance, has resulted in net load ramping challenges.

What is called the “duck curve” in the United States is the “emu curve” in Australia. As a result of net load issues, in March 2021, system operators were forced to curtail 12,000 rooftop solar PV installations to maintain system reliability.

As policy objectives and operational realities converge, these incidents are becoming more common.

While utilities are willing to find new ways to operate reliably, there may be an opportunity to better align policy with operational implications.

For instance, in some cases local utilities were not consulted before large solar incentives were rolled out. Grid upgrades were deployed to address power quality issues, but utilities did not have a clear mechanism to recover the costs.

Grid operators have managed to ensure reliability throughout the NEM, but this is becoming more challenging.

Forecasting Reliability Gaps: Urgent Need for Investment

The AMEO conducts an annual reliability assessment over a 10-year period to inform the planning and decision-making of market participants, new investors, and jurisdictional bodies.

In its most recent assessment, published in August 2022, the AEMO warned of near-term reliability gaps in South Australia and Victoria. More broadly, the AEMO forecast reliability gaps in all NEM mainland regions over the 10-year study period.

In the months since, near-term reliability concerns eased after new gas, wind, and battery developments and a delay to the retirement of existing gas generation.

Despite the near-term relief, reliability remains a long-term concern, and all mainland regions are forecast to experience reliability gaps by 2031 at present capacity commitments.

Even with additional investment, major reliability disruptions can still occur. The AEMO stresses an urgent need to invest in generation, long-duration storage, and transmission to meet long-term reliability requirements.

Key Takeaways: Proactive Engagement and Balanced Approach

Like in the United States, utilities in Australia have historically been tasked with providing safe, affordable, and reliable power. But as the energy transition accelerates, they must now also meet clean energy mandates and facilitate deployment of a growing concentration of increasingly distributed resources—a challenge not too dissimilar to that faced by U.S. utilities.

This challenge prompted two key learnings for the U.S. utility executives taking part on the trip.

First, the confluence of policy and operations requires active engagement with policymakers. It is essential for policymakers to understand the implications of clean energy policy on reliable electric service.

Success will require early and regular engagement with federal, state, and local policy makers. This is a tall order but an essential step to managing an accelerating energy transition.

Second, the balanced, pragmatic approach that utilities bring to the table is critical to enabling the clean energy transition. Sharing this perspective is essential given utilities’ unique position in driving a clean energy transition that creates beneficial outcomes for all parties.

Constructive engagement will require discussion of tradeoffs and actions needed to achieve common objectives. In both Australia and the United States, these discussions need to take place at all levels in order to reach the most efficient and effective outcome.

The Time Is Now: But How Fast?

The rapid change occurring in Australia should send a clear message to U.S. utilities—the energy transition will be both top down and bottom up. The risk is being caught in the middle.

To avoid this, utilities must proactively offer policymakers practical solutions. In practice, this may require a cultural shift from “yes, but…” to “yes, and…” solutions that strive to balance operational and policy objectives.

Globally, the energy transition will require massive new investments and new ways of operating the grid. It will also require honest discussion about the pace of change and the potential tradeoffs involved.

Utilities must lead as collaborative partners. Otherwise, the next decade may pose even greater operational challenges.