In November 2024, Brad DeMent and Trey Robinson from management consulting firm ScottMadden delivered a webinar to discuss the results of their latest finance shared services benchmarking study. Designed by ScottMadden and administered by APQC in June 2024, the study gathered data from respondents in 103 shared service organizations (SSOs) across four main areas:

- Delivery model and operations

- Staffing

- SSO management infrastructure and technology

- Performance

Drawing from the results of the survey, this article summarizes key findings and analysis related to cost savings in finance shared services. While shared service centers help to lower the cost of finance for many organizations, those with mature approaches to technology and process management often achieve significantly greater savings than their peers and competitors.

Non-Labor Savings Are Growing Rapidly

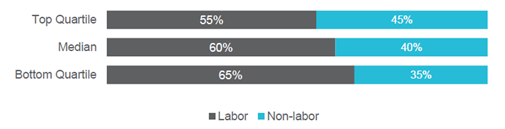

Traditionally, organizations implemented shared services as a way to reduce headcount and in turn labor costs, which are the largest driver of cost for the finance function. Labor-related savings continue to make up a majority of the savings generated by SSOs (Figure 1).

Robinson said that more recently, however, “we’re seeing more and more non-labor related savings.” At the median, SSOs now generate $593,128 of non-labor savings per $1 billion dollars in revenue, reflecting an increase of 63% since the previous survey.

Specific drivers of non-labor cost savings include:

- Accounts payable discounts (62% of respondents)

- Reduced errors and better controls (58%)

- Improved collections (54%)

- Better working capital (51%)

- Reduced turnover costs (e.g., training [45%])

- Reduced audit fees (31%)

Top Performers Save the Most

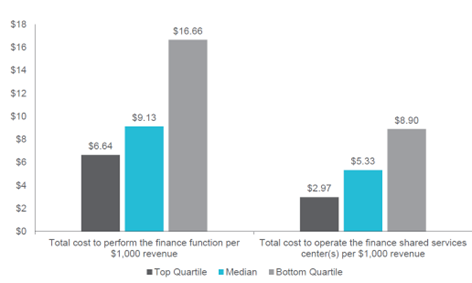

Through its analysis of shared services cost benchmarks, ScottMadden found that some organizations are spending significantly less than others to operate their SSO and the finance function as a whole (Figure 2).

Organizations in the bottom quartile spend the most to perform the finance function at $16.66 per $1,000 revenue, while organizations in the top quartile spend less than half that amount to carry out the same set of processes ($6.64). Organizations in the top quartile also operate their shared services center at about one-third the cost of organizations in the bottom quartile.

Top Performer Characteristics

Factors like industry, size, and global location(s) can all play a role in shaping what an organization spends on their shared service center and on the finance function as a whole. While these factors may account for some of the differences in spending between the top and bottom quartiles, it’s also true that some organizations spend less because they perform better and are more efficient across multiple areas.

To identify top performing SSOs, ScottMadden selected eight KPIs related to areas including staffing, efficiency, customer service, and cost. SSOs that fall into the top quartile for average scores across all eight KPIs are considered top performers. There were 28 SSOs that met these criteria and 75 in the comparison group (i.e., those not considered top performers).

Top Performers Have More Efficient Staffing

ScottMadden found several key differences between top performers and the comparison group that help explain why top performers are more cost efficient. One of the biggest differences is that top performing SSOs are staffed much more efficiently relative to the comparison group. Specifically, ScottMadden found that the top performer group has a median 25.4 full time- equivalent employees (FTEs) for the finance function, while the comparison group has more than three times as many finance FTEs (76.7 at the median).

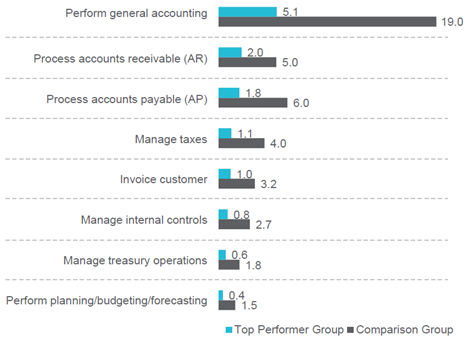

Top performers also have more efficient staffing across specific finance processes like general accounting, accounts receivable, accounts payable, customer invoicing, and more (Figure 3). Given the fact that labor is one of the biggest drivers of cost for the finance function, these efficiencies make a significant difference for overall spending.

Top performers don’t spend less and have leaner staffing because they do less. In fact, the opposite is true. ScottMadden found that relative to the comparison group, top performers:

- Offer a wider range of financial services. For example, they are 30% more likely than the comparison group to process customer credit.

- Are more likely to provide high-value services like planning/budgeting/forecasting and due diligence.

- Are less likely to outsource processes than the comparison group. For example, 15% of the comparison group outsources general accounting, compared to only seven percent of top performers.

Top Performers are More Mature with Respect to Technology

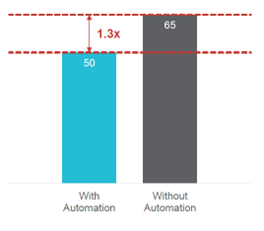

Top performers’ use of technology offers at least one important clue as to how this group is able to spend less and do more than their peers even with a smaller staff. Organizations that have implemented technologies like RPA, chatbots, predictive AI, or generative AI to automate finance processes have more efficient staffing, with a median of 50 finance FTEs per $1 billion revenue compared with 65 for organizations without automation (Figure 4).

Top performers are significantly more likely to have implemented these technologies. For example, almost half of the top performer group (46%) have implemented chatbots or virtual agents, while only 28% of the comparison group have.

See Automation and AI in Finance Shared Services: A Competitive Edge for Tomorrow for more findings and analysis related to technology.

A greater degree of automation means that fewer employees are needed to carry out core finance processes. This not only results in greater staffing efficiency overall but also frees up staff to perform higher-value services relative to the comparison group.

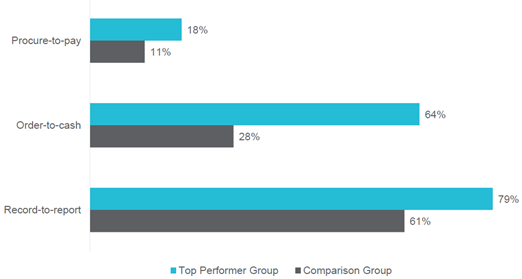

Top Performers Have More Mature Process Management

In addition to more efficient staffing and more mature approaches to technology, top performers also have more mature forms of process management. End-to-end (E2E) process adoption is a case in point. E2E processes help to break down silos across functions, enable a customer-centric view of processes, and provide visibility to ensure that improvements to one part of the process don’t end up causing problems for others. Relative to the comparison group, top performers are more likely to adopt E2E finance processes like procure-to-pay, order-to-cash, and record-to-report (Figure 5).

Top performers are also more likely than the comparison group to leverage global process owners as an approach to process governance (71% versus 61% respectively). Identifying an owner or owners for an end-to-end process ensures that someone is directly accountable for managing performance, mitigating risk, and identifying opportunities for process improvement.

Key Takeaways

Finance shared service centers can generate significant cost savings for organizations that are willing to invest in building and maturing them over time. Specifically, ScottMadden found that:

- While labor costs have traditionally been the biggest source of savings for SSOs, non labor-related cost savings are also growing rapidly.

- Top performers adopt automation technology to a greater extent than the comparison group. These technologies help to drive more efficient staffing, which in turn helps to lower costs overall.

- Top performers also have more robust forms of process governance that help to enable process improvement while mitigating risk.

- All three of these factors drive lower costs while enabling staff to carry out higher value work.

About this Research

ScottMadden partnered with APQC to develop and administer a custom study focused on finance shared services that is run on a biennial cycle. The 2024 survey is the seventh cycle of the study (previous cycles include 2014, 2015, 2016, 2018, 2020, and 2022).

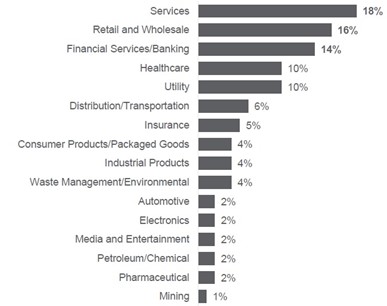

Respondents to the 2024 survey represent 103 SSOs across diverse industries including services, retail and wholesale, financial services and banking, and more (Figure 8).

All participating SSOs are based in the US or Canada and have more than $1 billion in annual revenue (with a median revenue of $12 billion). Almost all (91%) have been operating for three years or longer.

About APQC

APQC (American Productivity & Quality Center) is the world’s foremost authority in benchmarking, best practices, process and performance improvement, and knowledge management (KM). With more than 1,000 member organizations worldwide, APQC provides the information, data, and insights organizations need to support decision-making and develop internal skills. Learn more.

This content includes median values sourced from APQC’s Open Standards Benchmarking database. If you’re interested in having access to the 25th and 75th percentiles or additional metrics, including various peer group cuts, they are either available through a benchmark license or the Benchmarks on Demand tool depending on your organization’s membership type.

APQC’s Resource Library content leverages data from multiple sources. The Open Standards Benchmark repository is updated on a nightly cadence, whereas other data sources have differing schedules. To provide as much transparency as possible, APQC will always attempt to provide context for the data included in our content and leverage the most up-to-date data available at the time of publication.

About SCOTTMADDEN

ScottMadden has been a pioneer in corporate and shared services and has been helping companies transform their finance and accounting organizations for several decades. Through enterprise financial business services, strategic centers of expertise, intelligent automation solutions, hybrid insource/outsource delivery models, and other solutions, ScottMadden helps organizations increase value for their company. ScottMadden’s clients span a variety of industries from energy to healthcare to higher education to retail. To learn more, visit https://www.scottmadden.com/topic/finance-and-accounting/.