Originally published on Energy Central. Co-authored by Talha Sheikh and Jon Nichols.

Addressing Affordability in a Changing Energy Landscape

Energy affordability has emerged as an increasingly important topic in utility rate design amid transformations within the energy industry.

The confluence of new technologies, evolving policy directives, and shifting consumer expectations have led to significant changes in the energy industry. The changes continue to necessitate substantial investments and related costs to support an increasingly decarbonized, decentralized, and digitalized electric grid while maintaining safe and reliable service.

As utilities, regulators, and stakeholders grapple with the costs of transforming the electric grid, a key concern has emerged—the impact on low-income households which are disproportionately impacted by rate increases.

Innovations in utility rate designs have emerged to help address this concern and alleviate the energy cost burden on low-income households. However, designing rates to address affordability concerns entails a balance among competing rate design principles, including fairness, simplicity, economic efficiency, and promotion of energy efficiency and clean technologies.

Energy Affordability Is an Increasingly Important Topic

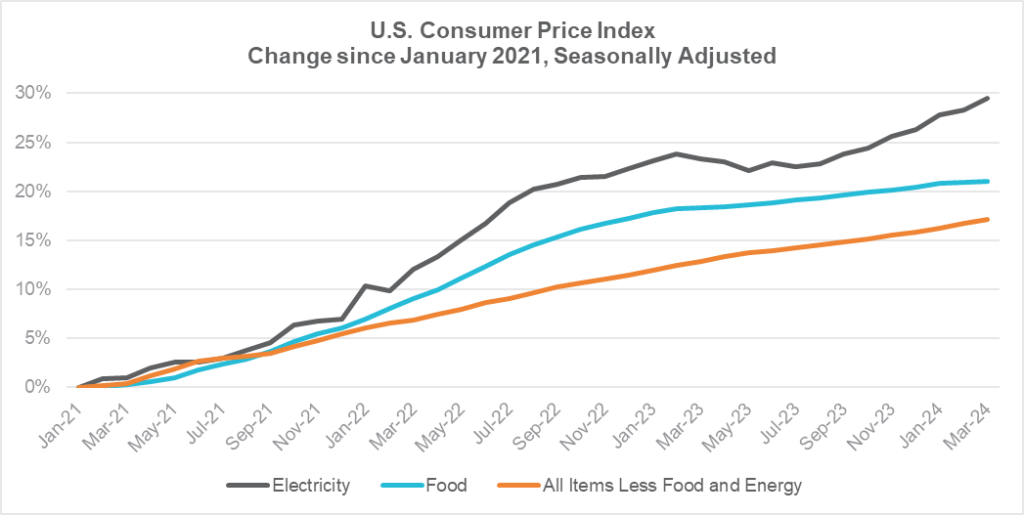

As the electric industry adapts to a changing energy landscape, new investments related to the replacement of aging infrastructure, growth in building and vehicle electrification, and clean energy requirements, coupled with rising operational costs, are driving electricity prices higher. Since the beginning of 2021, electricity prices have increased by 29%—far outpacing food and other consumer goods.

Source: U.S. Bureau of Labor Statistics

Consequently, energy affordability has become an increasing concern. The national median energy burden is 3.1%, but for low-income customers, the median energy burden is nearly three times more at 8.1%. The industry therefore faces a near-term challenge—how to improve the safety and reliability of the electric system and meet various grid needs and policy mandates while ensuring that electric services remain affordable.

Rate Design Solutions for Energy Affordability

In response to this challenge, utilities have embarked on rate design solutions aimed at mitigating the financial burdens of low-income households. Below are a few rate design features aimed at improving energy affordability:

- Expanding Eligibility: Utilities are expanding eligibility criteria for low-income discounts beyond federal poverty limits to encompass state-defined thresholds. For many years, the common upper limit to define a low-income household in the United States was 150% of the federal poverty line. More recently, programs have specified higher limits, such as 200% (e.g., California). Other measures have come into use as well, particularly the use of percentages of an area’s median household income or eligibility based on participation in other means-tested programs, such as the federal Low Income Home Energy Assistance Program or LIHEAP (an approach used in Massachusetts, for example).

- Facilitating Enrollment: Online enrollment, QR code, mobile-friendly enrollment, joint verification across dual utilities, self-certification, and annual re-enrollment are all characteristics that can facilitate enrollment and encourage participation in discount rate programs designed for low-income customers.

- Determining Discount Structures: Many utilities apply a discount to the overall bill (or the delivery portion of the bill in restructured jurisdictions) to simplify administration. However, other approaches include a customer charge reduction, a usage charge reduction, or both. For example, National Grid in Massachusetts currently offers a flat 32% discount to its customer charge and distribution charge for qualifying customers, whereas Duke Energy in North Carolina offers a $42 monthly credit for its income-eligible customers.

- Tailoring Discounts to Energy Burden: By offering discounts commensurate with the level of energy burden, utilities can ensure that low-income assistance is tailored to customers facing the greatest financial strain. For example, tiered discounts, which apply distinct discounts to various income tiers to achieve a target energy burden level, operate or are under consideration in multiple states, including New York, Massachusetts, and New Hampshire. Alternatively, percentage of income payment programs (PIPPs), which reduce energy burdens for low-income households by capping utility bill payments at a predetermined percentage of income, operate in many states, including Colorado, Illinois, and Virginia.

- Expanding Cost Recovery: Utilities are exploring options to broaden the base of cost recovery to encompass all customer classes. By spreading costs across a broader customer base, utilities can mitigate the impact of expenditures on individual ratepayers while maintaining affordability and equity in the provision of essential energy services.

Key Considerations in Designing Rate Solutions

As utilities explore rate design strategies to address affordability concerns, here are a few questions to consider:

- What rate designs will best meet energy affordability objectives (e.g., flat discount rates, tiered discount rates, PIPPs, etc.)?

- How will rate designs that address energy affordability concerns interact with existing low-income offerings, such as LIHEAP or existing discount rates?

- How will bill discounts that address energy affordability concerns be recovered and from which customer classes?

- How will rate designs that address energy affordability concerns balance other rate design principles, such as fairness, simplicity, economic efficiency, and promotion of energy efficiency and clean technologies?

- What rate designs will help maximize enrollment among eligible customers?

The changing energy landscape potentially leads to higher energy bills on the horizon. As higher bills disproportionately impact low-income households, the energy industry is exploring rate design solutions that balance affordability and equity concerns with policy objectives and established rate-making principles.