Introduction

On December 13, 2018, the New York Public Service Commission (PSC) issued an Order[1] setting energy storage targets for New York state and establishing policies to drive energy storage development. The Order enacted many of the recommendations from the New York State Energy Storage Roadmap,[2] published in June 2018 by the New York State Department of Public Service (DPS) and New York State Energy Research and Development Authority (NYSERDA). The goal of the Order was to “accelerate the market learning curve and drive down costs, thus speeding the deployment of energy storage at scale through the highest-value applications.” The Order provided some policy direction while leaving other issues unresolved. In the sections below, we explore the key topics that were defined, such as the targets, the bulk procurement that will be conducted by utilities, and the funding incentives meant to provide the near-term “missing money.” We also review what was not (or could not be) resolved through the Order.

Target Established

When the Order was issued, the headline-grabbing attention was the 3,000 MW target by 2030, with an interim goal of 1,500 MW by 2025. In terms of capacity, this represented the most ambitious state target to date. However, the 2030 target is described as an “aspirational deployment goal,” and only 350 MW were mandated. In addition, a triennial review “will help provide certainty to the varied market participants that the deployment goals and associated policies will be realistic and adjusted accordingly based on market conditions.”[3] In keeping with Reforming the Energy Vision’s (REV) stated objectives, ultimately the achievement of New York’s energy goals will be driven by market adoption, rather than policy mandate.

Bulk Procurement

As mentioned previously, the PSC established targets for the direct procurement of energy storage by the state’s investor-owned utilities (IOUs) subject to its jurisdiction. Collectively, New York’s IOUs were ordered to procure a minimum of 350 MW of storage by 2022. The Order required Consolidated Edison Company of New York (Con Edison) to procure at least 300 MW and each of the other electric IOUs to procure at least 10 MW each. This part of the Order and subsequent compliance filings raised three interesting points:

- Contract Structure – For this procurement, the IOUs will contract for the full dispatch rights of the storage asset for up to seven years while developers retain asset ownership. This structure will provide a fixed revenue stream to the developer and experienced operating storage assets to the utility. Utilities may use the storage to provide wholesale services or meet distribution needs (reliability services, load relief, or environmental benefits). This is intended to stimulate the marketplace in meeting the state’s storage target.

- Benefit Cost Analysis – The bulk procurement imposes a utility-specific cost ceiling, but it stops short of requiring that a benefit cost analysis (BCA)[4] be performed, as is required for other REV-related initiatives, such as non-wires alternatives (NWA). However, utilities will amortize and recover the costs over the length of the contract in the same manner as NWAs, offsetting costs with any wholesale revenues collected.

- Implementation Plans – In early February 2019, the IOUs filed implementation plans outlining the processes through which they will conduct the bulk storage procurements. The implementation plans indicate a variety of approaches from leveraging the storage procurements from primarily bulk-system energy storage projects, which support peaker and transmission assets by Con Edison, to primarily distribution benefits outlined by some of New York’s upstate utilities.

NYSERDA Bridge Incentive and Soft Cost Reductions

The Order also required that NYSERDA establish and administer a “bridge” incentive in order to accelerate the energy storage learning curve, drive down costs, provide revenue certainty to  developers, and speed the deployment and utilization of energy storage until such time as markets are able to drive storage deployment. NYSERDA will fund the incentive out of previously collected ratepayer funds, and it will consist of a $130 million retail incentive and a $150 million bulk incentive with $70 million reserved for the DPS to allocate as needed. The bulk incentive will consist of either a standard offer, which is designed as a $/kWh incentive in declining annual tranches, or an incentive for the IOU bulk storage procurements to provide funding based on the economic evaluation of bids.

developers, and speed the deployment and utilization of energy storage until such time as markets are able to drive storage deployment. NYSERDA will fund the incentive out of previously collected ratepayer funds, and it will consist of a $130 million retail incentive and a $150 million bulk incentive with $70 million reserved for the DPS to allocate as needed. The bulk incentive will consist of either a standard offer, which is designed as a $/kWh incentive in declining annual tranches, or an incentive for the IOU bulk storage procurements to provide funding based on the economic evaluation of bids.

The retail incentive is a $/kWh incentive for up to six hours of discharge duration. Retail incentive values will vary by geographic interconnection point (New York City, Long Island, and the rest of the state) and decline as tranches are filled.

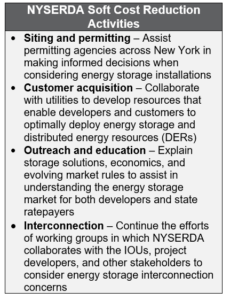

The PSC expects these incentives, combined with NYSERDA incentives on Long Island and other actions, to reduce the soft costs of energy storage (see insert), resulting in the deployment of at least 500 MW of storage by 2022. NYSERDA’s implementation plan for the program goals and implementation strategies was filed on March 11, 2019.

Unresolved Issues

With a regulatory reform effort as complex as REV and a resource as flexible as storage, capturing all the possible policy permutations in one order would be nearly impossible. Indeed, that was the case with the New York storage order, as several roadmap recommendations were discussed, but ultimately deferred to other proceedings or to be resumed at a later date. Chief among these was the interaction of storage systems with the wholesale market, which is explored in its own section below. Other topics that were deferred include:

- Rate Design – Re-examining rules for charging and discharging in order to incentivize the desired behavior while avoiding uneconomic retail rate arbitrage was a key issue in determining how best to use energy storage. A range of retail rate design proposals was recommended in the NYSERDA roadmap; however, these were largely deferred to as the Value of DER (VDER) proceeding[5] and the VDER rate design working group.

- Clean Peak – The energy storage roadmap recommended a study to assess the reliability and operational characteristics of existing peaker generators to determine if clean resources can provide equivalent services. In the Order, the PSC noted that several of the requirements (e.g., a differentiated environmental value in the value stack, which is discussed below) were aimed at using more clean resources during system peak. The PSC further orders staff, NYISO, NYSERDA, Departmental of Environmental Conservation, LIPA, and Con Edison to develop a methodology to determine how many MWs of peaking units could be replaced or repowered economically with energy storage and what level of clean resources provide the same level of reliability. This methodology and analysis are to be documented in a report to be filed on July 1, 2019.

- Optionality Value – Given the flexibility and multitude of uses of energy storage, the roadmap recommended creating an optionality value in addition to the discrete values currently captured in the BCA Framework. Due to the complexity of valuing optionality, the PSC deferred action to the ongoing distribution system implementation plan (DSIP) proceeding.

- Shaped E-Value – The roadmap recommended assessing the environmental value (E-value) of energy storage based on the difference in emission profiles between the generator that charges the storage system and the generator that the storage system displaces at the time of discharge. For instance, if a storage system was charged from a solar panel mid-day and discharged at the time of system peak when a natural gas peaking unit was needed, the beneficial reduction of emissions would be attributed to the storage system for the time period of the discharge. The PSC ordered DPS to develop a white paper by the summer of 2019 using input from the VDER working group.

Wholesale Market

In the June 2018 roadmap published by DPS and NYSERDA, DPS proposed a number of items related to wholesale markets, such as dual participation and distribution and wholesale market coordination. In parallel, the New York Independent System Operator (NYSIO) was developing the wholesale market rules in response to the Federal Energy Regulatory Commission’s (FERC) Order 841. In December 2018, NYISO released its revised tariff, which outlined the market rules needed to establish a new participation model for energy storage resources.[6] In the Order, the PSC proposed ongoing coordination among NYISO and DPS, NYSERDA, the Joint Utilities, and other stakeholders through a market design and integration working group to coordinate and resolve outstanding challenges with integration of storage and DERs into wholesale markets.

Dual participation continues to present a significant challenge for optimizing the value of a flexible resource like energy storage. Energy storage can provide both wholesale and retail value, but this dual participation must be coordinated to prevent overcommitting the resource. In its Order 841 Compliance Filing Letter, NYISO noted that the stakeholders requested dual participation rules, but “NYISO declined to address these proposed changes as they are beyond the scope of the Order No. 841.”[7] Unable to set wholesale market rules through the Order, the PSC established guiding principles or dispatch priorities for dual participation and required:

- DPS staff and NYSERDA to convene a market design and integration working group with appropriate contributors from the IOUs and NYISO

- IOUs to prepare and file a market design and integration report to be filed as part of the DSIP proceeding, which was to describe the utilities’ shared plan for designing, implementing, and managing DSP market functions that will enable dual participation

Conclusion

While the Order provided an aspirational target and near-term clarity on utility procurement targets and bridge incentives, it deferred some of the biggest questions around energy storage, such as distribution and wholesale market coordination, dual market participation, and rate design, which were pushed to other proceedings or working groups. Some of the key issues to watch as this proceeding continues to evolve are:

- Do the interim and aspirational targets become firm commitments?

- Will the bulk procurement and NYSERDA bridge incentive be effective at driving down storage costs?

- Will cost-effective business models emerge for storage at the bulk and distribution levels?

- What is next for dual participation? Is dual participation necessary to realize the full value of energy storage?

- How will the market design and integration working group process shape the future of the distributed system platform in New York?

Additional contributing author: Benjamin Lozier

[1] Case 18-E-0130, In the Matter of Energy Storage Deployment Program, Order Establishing Energy Storage Goal and Deployment Policy (“Energy Storage Order” or “Order”), issued December 13, 2018.

[2] Case 18-E-0130, In the Matter of Energy Storage Deployment Program, New York State Energy Storage Roadmap (“Energy Storage Roadmap” or “Roadmap”), issued June 22, 2018.

[3] Energy Storage Order, p 12.

[4] The BCA Framework was established early in the REV proceeding (14-M-0101) as the mechanisms for comparing the cost effectiveness of non-traditional solutions to traditional utility infrastructure. Utility-specific handbooks show how the framework is applied in their respective service territories and have been included with the distribution system implementation plan (DSIP) filings in Docket 16-M-0411.

[5] Docket 15-E-0751

[6] https://elibrary-backup.ferc.gov/idmws/common/OpenNat.asp?fileID=15109126

[7] https://elibrary-backup.ferc.gov/idmws/common/OpenNat.asp?fileID=15109126, p. 12