At your company, is it smooth sailing for Financial Planning and Analysis (FP&A), the group responsible for providing strategic, real-time business intelligence? Are you confident that FP&A enables business as usual and shapes business transformation effectively? Could FP&A be leaner and more efficient?

Corporate leadership and business units demand financial agility given the pressures of today’s rapidly morphing and volatile business landscape. To compete and innovate successfully, customers unprecedentedly require actionable, accurate analyses in near real time.

Over the past two decades, financial shared services gained from standardizing, consolidating, and automating general accounting activities. Now, a more mature financial shared services offers advanced capabilities, providing new FP&A options for service delivery. By employing shared services to support work, FP&A can capitalize on shared services’ features to improve performance and add value for customers. The next wave of financial shared services emerges on the horizon.

The Water Today

FP&A’s typical structure features both corporate centralization and business unit decentralization across the globe. Embedded among the business units, FP&A unavoidably performs processes and procedures specific to each business. Time-consuming administrative research and basic calculations burden staff, leave little time for strategic analytics, and underutilize FP&A’s deep financial knowledge and advanced degrees. Business intelligence tools, if existing, may connect to disparate and conflicting data sources, causing unnecessary data cleansing and poor accuracy. The waters appear choppy.

FP&A Now

- Budgeting and forecasting processes can be inconsistent from one unit to another. Lack of standardization may increase complexity for frontline FP&A workers. A survey of finance professionals revealed that only 4 out of 10 participants were willing to rate their current FP&A capabilities as effective[1]

- FP&A staff may fail to meet the requirement of processing enormous amounts of data to provide operational insights in a timely manner. Only one-third of survey participants believed that their current FP&A model keeps up with the pace and needs of unfolding business strategy[2]

- FP&A may lack time to focus on modeling that defines key business drivers and performs predictive analytics. A survey found nearly two-thirds of FP&A resources are buried in basic, transactional processing[3]

- FP&A may be unable to provide sophisticated scenario and sensitivity analyses. In a recent survey, nearly 60% of FP&A organizations only conducted basic cause-and-effect analysis and not much more. Relatively few engaged in advanced analytics[4]

- Costs could be out of line since standard analyses, common business Q&A, and routine report preparation encumber highly compensated FP&A staff

- Non-centralized data could weaken and lower quality of reporting and analyses. It is not uncommon to find FP&A tapping into 10 or more different systems in the course of periodic financial reporting.[5] One-third of survey participants cited lack of access to operational metrics barred them from improving FP&A’s value to the business[6]

- Significant customized reporting for each business unit may not be needed and detract from enterprise reporting

- Business units may miss learning from one another’s best practices

FP&A Activities

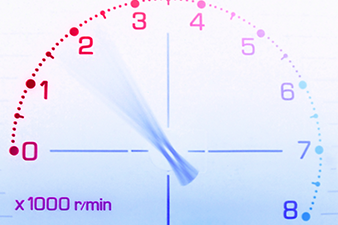

Traditionally, many executives do not consider FP&A activities as a viable option for shared services due to the customized, analytical, and judgement-based nature of the work. While not all FP&A activities should be supported by a shared services center, closer inspection reveals that perhaps some activities could be supported. Repetitive, data-intensive activities heavily reliant on global standards and centralized data appear as the most likely candidates to benefit from a consolidated environment (Figure 1). Business risks today, coupled with a long-term familiarity with shared services capabilities, challenge companies to evaluate new options for FP&A service delivery.

Figure 1. FP&A Activities that Could Be Supported by Shared Services

Spotting the Next Wave

An opportunity exists to improve performance and provide even more value to FP&A’s corporate leadership and business unit customers through an enhanced shared services model. FP&A can meet unprecedented demand for real-time data analyses and strategic insights by changing some methods of service delivery. The next wave gains momentum as it approaches the horizon.

Shared Services Capabilities

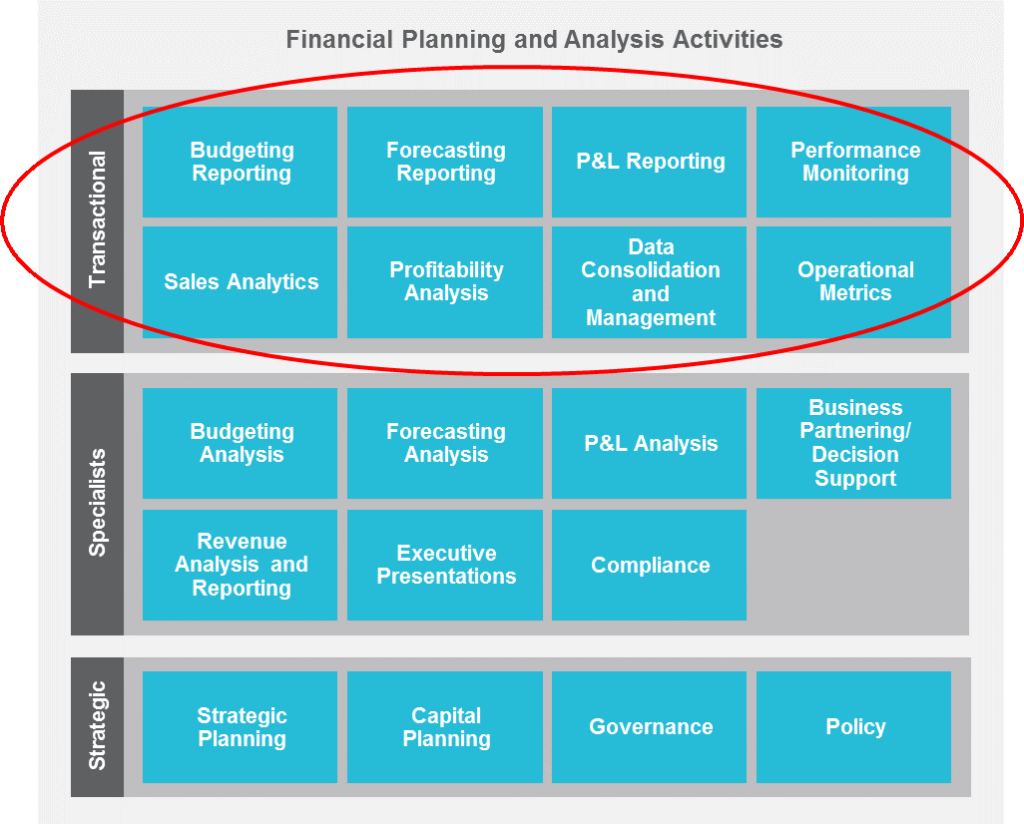

Shared services offers distinct capabilities from which FP&A should take advantage:

- Standardization – Consolidation allows FP&A to evaluate and institute leading practices for standardized, better reporting

- Skilled Professionals – Shared services professionals’ skills in accounting and data consolidation can standardize repetitive, analytical tasks; offloading this work enables more expensive FP&A talent to focus on forecasting, planning, and analysis activities for the business lines

- People Alignment – A shared services model produces cost savings by freeing FP&A resources from transactional processing. Best-in-class companies typically have four to six well-compensated FTEs per $1 billion dollars in revenue performing FP&A activities in a consolidated environment[7]

Customer Benefits

Not only will FP&A benefit from outcomes of shared services capabilities, its customers will benefit as well. Leading shared services attune to and routinely monitor internal customer needs. Service management tools inherent in a shared services organization, such as business intelligence applications, case management systems, knowledge-based tools, and customer relationship management applications, can be leveraged to improve service for FP&A customers. Changing the way FP&A delivers some services improves performance and creates additional value for corporate finance and the business units (Figure 2).

Figure 2. Creating Value for FP&A Customers

Riding the Next Wave

The next wave seems daunting to catch—business customers and senior finance executives are protective of local FP&A resources. They may resist centralizing FP&A work due to its perceived closeness to frontline operations. Moreover, many operational challenges loom. Don’t wipe out.

Main Considerations for Shared Services Support

Committing to support some FP&A activities through shared services raises many questions that need answering:

- Stakeholder Engagement

- Who will sponsor your project?

- Do you have executive commitment?

- Who is included on the project team?

- Scope

- What FP&A activities can and make sense to be supported by shared services?

- What opportunities exist for standardization and adoption of leading practices?

- What will handoffs look like among various areas of finance?

- Service Delivery

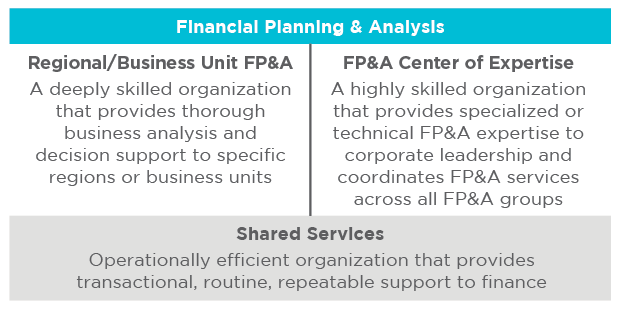

- What model do you use to support services? Do you use a shared services center, center of expertise, or a hybrid (Figure 3)?

- How do you balance global locations?

- People

- How do you hire and train people for a specialized, customer-facing skill set?

- What is the new financial career path?

- How do you manage the change for your organization?

- Governance

- Who is responsible for what?

- What does the end-to-end process look like?

- What are your service levels?

- What are your performance metrics?

- Who will monitor and how?

- Technology

- How and what data will be structured and utilized?

- Are you employing the right analytical engines?

- Are there other opportunities for automation?

Figure 3. FP&A Service Delivery Model

Getting It Done Right

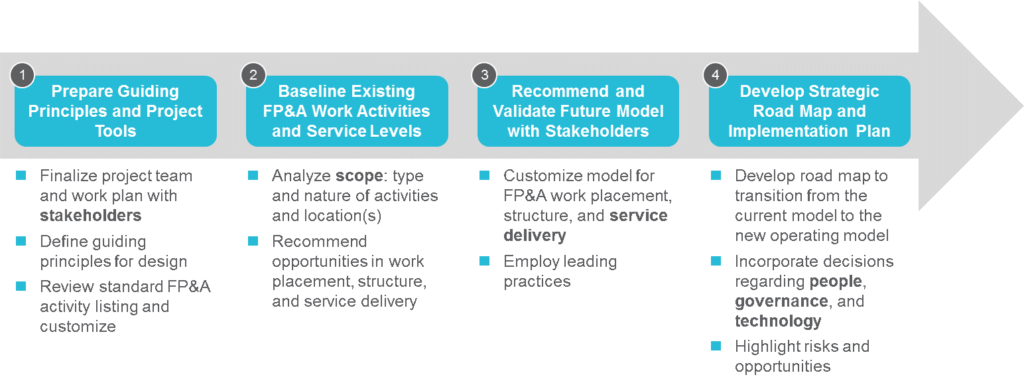

Companies trust ScottMadden to partner with them on these main considerations for expanding their business services to incorporate FP&A activities. ScottMadden developed a framework that ensures success with supporting certain FP&A activities through shared services (Figure 4).

Figure 4. ScottMadden FP&A Service Support Methodology

ScottMadden’s proven methodology instills confidence in a thorough implementation plan. We leverage our deep financial expertise and large multinational company experience to handle your financial service delivery successfully. Our collaborative and customized approach creates the right FP&A hybrid service delivery model for your company. But most importantly, our smaller, multicultural and multilingual teams work seamlessly and easily with your global employees. Team with us.

Conclusion

Early adopters challenged the status quo and proved that supporting some FP&A activities through shared services can achieve meaningful cost savings, while empowering frontline FP&A groups and improving overall performance. Trust ScottMadden to leverage the strengths of your existing operations and craft new custom solutions that improve the way you provide FP&A services to your business lines.

[1] “Financial Planning and Analysis: Influencing Corporate Performance with Stellar Processes, People, and Technology,” APQC 2015

[2] See Footnote 1

[3] “Free Resources from Transaction Processing by Upgrading FP&A Capabilities,” APQC 2015

[4] “FP&A: An Evergreen Challenge,” APQC 2015

[5] See Footnote 4

[6] See Footnote 1

[7] ScottMadden Financial Management Shared Services Benchmarking Survey, 2014