Historically, natural gas utility planning has been straightforward. The focus has been on:

- Forecasting growth

- Supporting growth

- Maintaining and monitoring the system

- Improving the system

- Sourcing natural gas commodity

- Supporting customers’ needs

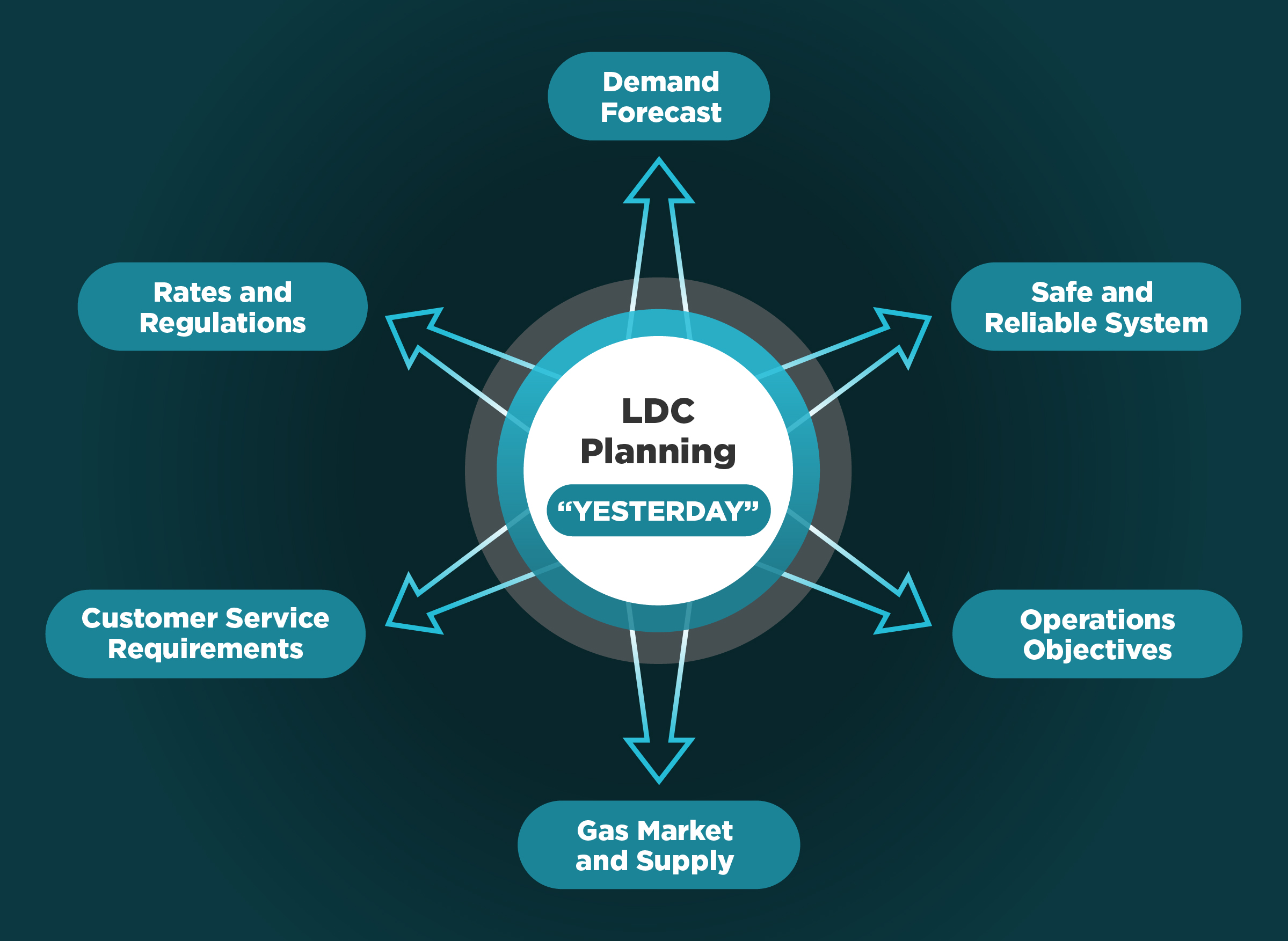

Natural gas LDC planning has been driven by a few key factors and answers to key questions, including:

Demand Forecast

- How many new customers will we need to serve?

- What types of customers are these (residential, commercial, industrial)? How much gas will they need and when?

- Where are these new customers? Can our system serve as is, or do we need to add infrastructure (pipes and compression)?

- What do our existing customers need?

Safe and Reliable System

- What is the condition of our existing system?

- What does our DIMP/TIMP1 tell us we need to do?

Operations Objectives

- What other operating objectives do we have (operating efficiencies and improvements, etc.)?

Gas Market and Supply

- What do forecasts tell us about pricing and types of contracts we need?

- What is the forecast for surety of supply?

Customer Service Requirements

- What do our customers want and need?

- Are customer service improvements needed?

Rates and Regulations

- Do our forecasts indicate needed rate cases?

- Are regulators asking for any special requirements?

- What about shareholders?

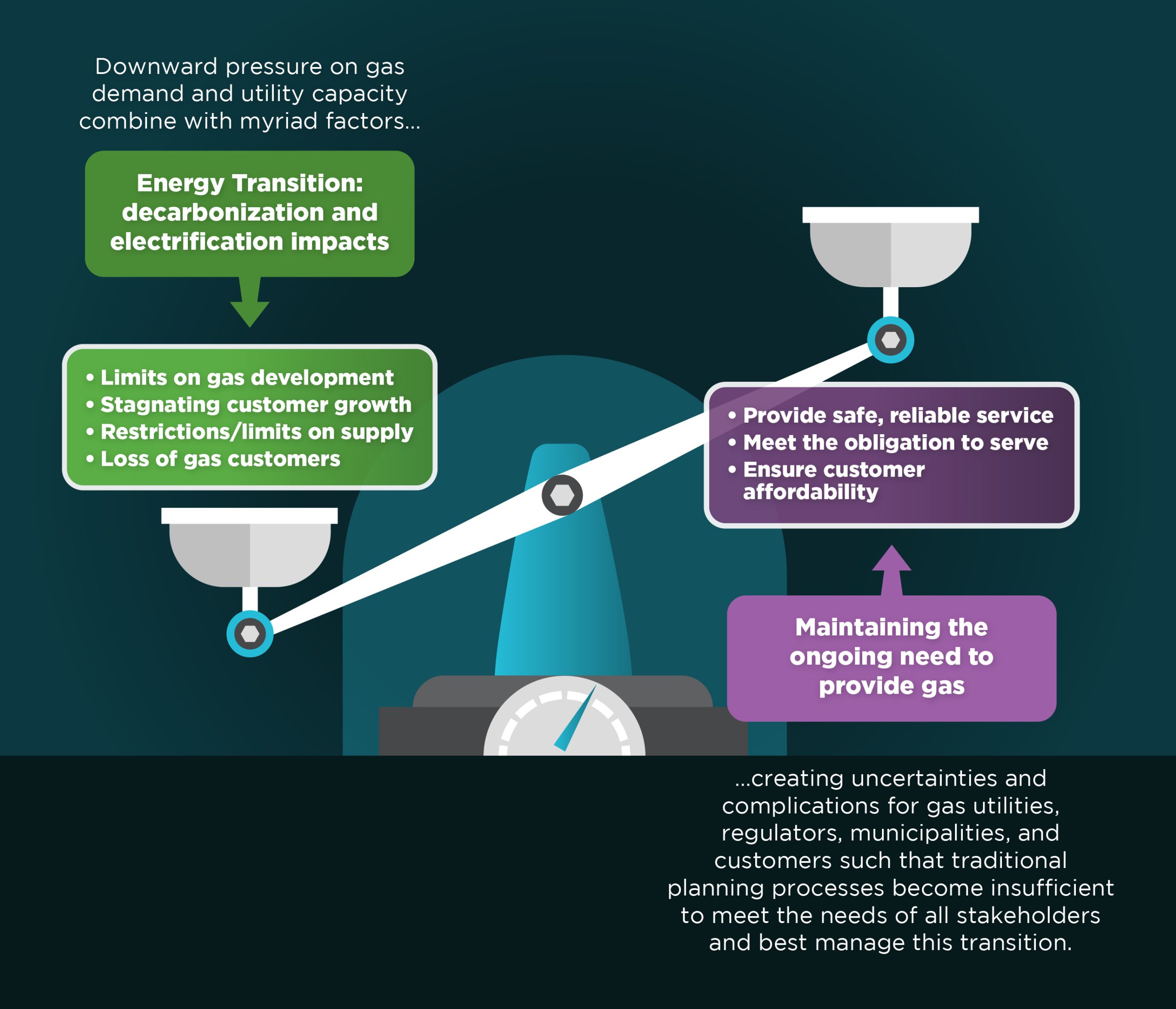

Traditional “growth-based” planning factors for LDCs have changed and have become much more complicated

Today more factors and questions impact planning, including:

Decarbonization

- What is the impact to the system (leak mitigation/elimination)?

- What is the timing to meet standard?

Electrification and Customer Choice

-

Will customers switch heating and cooking fuels? When? Where?

-

Do they have to? What is the rate of current and new customer losses? Does energy choice exist?

Affordability

- Can (remaining) customers afford gas service?

- Can customers afford to switch?

Technology Availability/Viability

- Do current technologies meet decarbonization and affordability needs?

- What is on the horizon and what does it mean?

“Alternative” Gases

-

Is Renewable Natural Gas (RNG) available, viable, affordable?

-

Can hydrogen be developed and used to meet needs?

Additional Regulatory and Legislative Actions

-

Is there a “Future of Gas” proceeding”

-

Are there other rules that will impact gas operations?

-

Can we expand the system and develop new customers?

How do you balance and manage the opposing forces of this transition?

What should the LDC do? There are four key actions:

1. Use advanced forecasting models moving from deterministic forecasting and planning models to stochastic (probabilistic) models

- Probabilistic modeling is increasingly important as the impact of energy transition activities (e.g., electrification) on gas demand and infrastructure increases

- Probabilistic modeling accounts for the numerous impacts to the planning assumptions (e.g., growth of renewables, electric switching and load growth, regulatory policy trajectory, the cost of capital)

2. Increase granularity of gas forecasting to match and align with that of the associated electric utility plan

- Improved understanding of the consumer demand for electrification, customer segmentation, price sensitivity, and other variables which influence consumer demand for fuel switching

- Combined gas and electric utility preliminary engineering studies using sample communities to create a more sophisticated picture of implications and possibilities of electrification scenarios

3. Perform scenario analysis for the energy transition to support divergent assumptions about growth in energy alternatives

- Informed by stochastic modeling to assist in testing portfolio performance with uncertainties, including changes in customers

- Responding to and incorporating the regulatory and political environment. Enhance ability to get ahead of the curve with regulators, including the ability to help inform and shape rules

4. Develop alternative options to support their core business

- Expansion of energy efficiency programs and other non-pipes alternatives consisting of targeted, locational strategies to lower costs and emissions

- Consideration and assessment of alternative fuel options such as RNG and hydrogen. Alternative compliance options, depending on rules or legislation, could include certificates of environmental attributes as well as system leak identification and reduction programs and infrastructure integrity management

- Exploring programmatic options to potentially support beneficial electrification through performance-based regulation and recovery

Transition Management Planning for Gas Utilities Is Essential

The natural gas industry is transforming and the need for utility planning to likewise evolve is becoming evident.

As LDCs balance the traditional goals of ensuring safety, reliability, and affordability with clean energy objectives, the need for a holistic, comprehensive view of asset portfolios is critical.

ScottMadden is actively working with its clients to evolve utility planning and enable the clean energy transition.

Contact ScottMadden to find out how natural gas utilities can use transition management planning to meet their decarbonization goals, improve system safety, reliability, and resilience, improve the customer experience, and continue to provide a valuable and vibrant energy source to customers today and tomorrow.