When the Inflation Reduction Act (IRA) was signed into law in late 2022, it became clear that it would change the energy landscape. The IRA introduced numerous opportunities for tax benefits. One notable provision offers enhanced credits for specific projects, contingent upon meeting prevailing wage requirements.

Prevailing wage is a federal term for the average wage1 paid to a specific type of worker on a particular type of project within a defined geographical region. An individual qualified worker meets prevailing wage standards if their wages are not less than the prevailing wage for their type of work on their type of project in their geography.

The enhanced tax credit is not small – qualifying projects can receive a 5x multiplier on Investment Tax Credits (ITC) or Production Tax Credits (PTC). This means that if every worker on your project can be proven to be paid not less than prevailing wage rates, instead of receiving a 0.3 cents per kilowatthour (kWh) production tax credit you would receive a 1.5 cents per kWh tax credit. While this sounds simple enough, proving your project meets prevailing wage requirements is not as straight forward as it seems, and developing the right methodology is essential to meeting the requirement.

This means that if every worker on your project can be proven to be paid not less than prevailing wage rates, you would receive a 1.5 cents per kWh PTC rather than a 0.3 cent per kWh PTC.

Who typically qualifies for the incentive?

Almost any project in a clean energy, emissions reduction, or climate-related field qualifies for the added incentive. The following are examples of project types with enhanced tax credits available if a project owner proves to the Internal Revenue Service (IRS) that workers on their project are paid at wages not less than prevailing wage rates:

- Building vehicle charging or clean fueling stations

- Renewable electricity power production

- Carbon Oxide Sequestration

- Zero-emission nuclear power production

- Clean hydrogen production

- Clean electricity production

- Clean fuel production

- Clean electricity investment

- Advanced energy investment

- Energy-efficient commercial buildings

Do all workers need to meet prevailing wage requirements?

Prevailing wage is meant to ensure the fair pay of a classification of workers identified as “laborers and mechanics,” not those workers whose duties are primarily administrative or clerical. While the definition of this group is opaque, the main classification is a worker whose duties are manual or physical in nature. This includes apprentices, helpers, watchpersons or guards, and forepersons who devote more than 20% of their time to mechanical or labor duties.2

Under the IRA, prevailing wages are required for laborers and mechanics engaged in facility alteration or repair, encompassing tasks like construction, remodeling, installation, painting, decorating, and manufacturing. However, maintenance work of a routine nature is exempted. Determining eligibility can be challenging, particularly for facilities eligible for tax credits, which often blur the line between maintenance and alterations.

Put simply, there is no single definition for who should be considered in prevailing wage determination. Each industry, company, and facility will have to determine that for themselves and prove they’ve done so to the IRS.

How do you prove you’re satisfying prevailing wage?

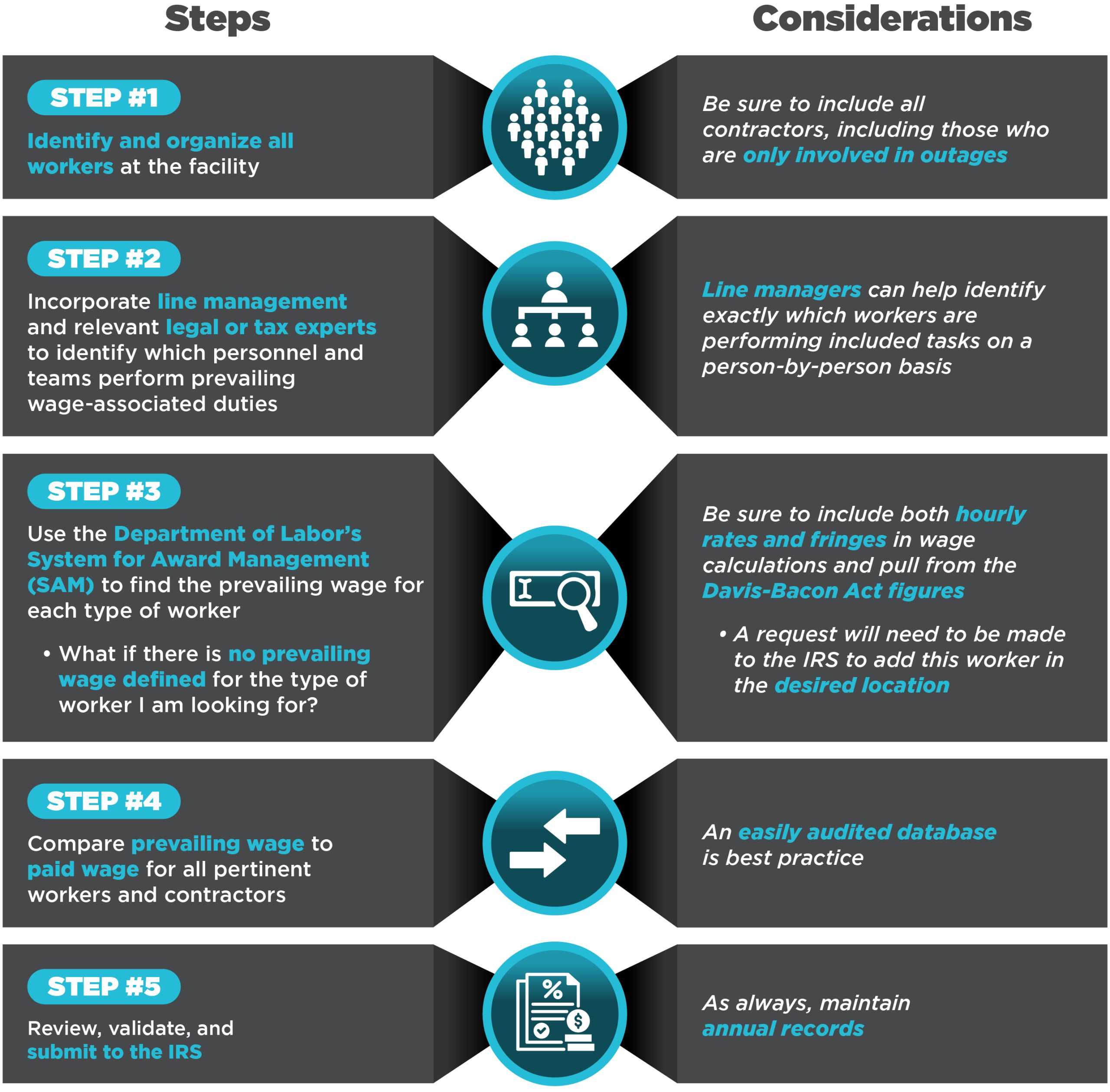

Every entity is responsible for proving to the IRS that the personnel at their sites performing relevant work duties meet or surpass prevailing wage determination. A good prevailing wage methodology does not have to be complicated, but it does have to be comprehensive and easy to audit. Assessing workers one-by-one leads to inconsistent results that are not verifiable to the IRS. Instead, ScottMadden suggests building a reliable methodology for evaluating workers based on their roles, responsibilities, and scope of work. This methodology should be applicable across entire facilities and fleets. Here are the steps we recommend to get you started:

From our experience in providing wage determination methodologies and guidance, here are a few things to keep in mind as you create your own methodology:

- Start with departments: While it may seem intuitive to start with employees, wait! Looking for entire teams or departments that are not required to meet prevailing wage requirements may save you time. Administrative, engineering, and clerical departments can all be ruled out collectively, keeping you from reviewing the same type of work classification again and again.

- Rule out, not in: Because of the gray area around the designation of “laborers and mechanics” and “repairs and alteration”, it’s easier to identify jobs that do not fit in than it is to identify those that do. Start with the assumption that all employees are prevailing wage workers and remove people as you go.

- Keep it simple: When looking at thousands of facility employees or entire workforces, it can get complicated fast! Make sure to keep in mind the fundamentals of what makes a worker qualified for prevailing wage determination. Create a process that is repeatable and easy to keep updated for future projects.

At ScottMadden, we are here to help you develop and deploy a methodology that fits your unique project needs and offer guidance and support for grant applications and tax credits. If you’re interested in speaking with some of our experts about prevailing wage or the Inflation Reduction Act, reach out to Ed and Morgan at their contact cards at the top of this article!

1 Wage includes hourly rates and fringe benefits

2 https://www.ecfr.gov/current/title-29/subtitle-A/part-5/subpart-A/section-5.2